Why Student Loan Refinance Rates Can Transform Your Financial Future

Securing one of the lowest student loan refinance rates could save you thousands of dollars. With rates for qualified borrowers starting as low as 3.49% APR, it’s a powerful tool for managing debt. Here’s a quick look at the current landscape:

Current Lowest Rates Available:

- Fixed rates: Starting at 4.29% – 5.24% APR

- Variable rates: Starting at 5.28% – 6.24% APR

- With autopay discount: Additional 0.25% reduction

- Best rates require: Credit scores 650+, stable income, and a low debt-to-income ratio.

Refinancing can lower your monthly payment or help you pay off debt faster. However, it’s not for everyone. When you refinance federal loans, you permanently lose access to federal protections like income-driven repayment plans and loan forgiveness programs. This is a critical trade-off to consider.

Many lenders let you check your rate in minutes without impacting your credit score, making it easy to explore your options. Understanding today’s refinance landscape is the first step toward financial freedom. As you work on your finances, some find that focusing on abundance helps, like with this 7-second wealth manifestation ritual.

Lowest student loan refinance rates terms to learn:

Understanding Today’s Student Loan Refinance Landscape

Navigating the student loan refinance market can feel complex, but understanding the basics makes finding the lowest student loan refinance rates much easier. Lender competition is high, creating more opportunities for borrowers to secure favorable terms.

What are the current lowest student loan refinance rates available?

Today’s rates are competitive, though not at the historic lows of a few years ago. The best advertised rates require excellent credit, stable income, and a low debt-to-income ratio.

- Fixed rates currently start around 4.29% to 5.24% APR for top-tier borrowers, with some promotional rates as low as 3.49% APR. For those with less favorable credit, rates can climb to 9.99% APR or higher.

- Variable rates often start lower, from 5.28% to 6.24% APR. These rates are tied to market indices and can change, meaning your payment could rise or fall over time.

- Autopay discounts are an easy win. Most lenders offer a 0.25% rate reduction for setting up automatic payments, which can add up to significant savings over the life of the loan.

While rates fluctuate with the market, many borrowers can still achieve significant savings compared to their original loans. The key is to shop around and understand what influences your specific rate offer.

Fixed vs. Variable Rates: Which Is Better for You?

Choosing between a fixed and variable rate is a key decision based on your financial stability and risk tolerance.

Fixed rates offer predictability. Your interest rate and monthly payment remain the same for the entire loan term, making budgeting simple. This security typically comes with a slightly higher starting rate.

Variable rates offer a lower initial rate, which could mean smaller payments at first. However, these rates are tied to a market index like the SOFR (Secured Overnight Financing Rate) and can fluctuate. This option carries more risk but can be beneficial if you plan to pay off the loan quickly.

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Interest Rate | Stays the same for the life of the loan | Fluctuates with market index (e.g., SOFR) |

| Monthly Payment | Consistent and predictable | Can increase or decrease over time |

| Initial Rate | Typically higher | Often lower |

| Risk | Low risk of increasing payments | Higher risk of increasing payments |

| Predictability | High | Low |

| Ideal For | Budgeting stability, long repayment terms | Short repayment terms, comfortable with risk |

Key Factors That Influence Your Offered Rate

Lenders assess several factors to determine your reliability and offer you a rate. Improving these can help you qualify for the lowest student loan refinance rates.

- Credit Score: This is the most important factor. A score in the high 600s is often required to qualify, but scores of 750+ receive the best rates. Learn how to improve your credit score before applying.

- Income: Lenders need to see stable employment and sufficient income to cover your new payment and other obligations.

- Debt-to-Income (DTI) Ratio: This is your total monthly debt divided by your gross monthly income. A DTI below 50% is generally required, but lower is better.

- Loan Term: Shorter terms (5-7 years) usually have lower interest rates but higher monthly payments. Longer terms (15-20 years) have lower payments but higher rates.

- Co-signer: Adding a co-signer with excellent credit can help you qualify for a much better rate if your own profile is still developing.

As you work on your finances, you might also consider flexible income sources like live chat jobs or exploring mindset techniques like this 7-second wealth manifestation ritual. For a full walkthrough, see our step-by-step refinancing guide.

How to Find and Qualify for the Lowest Student Loan Refinance Rates

Securing the lowest student loan refinance rates is about presenting your best financial self to lenders. Here’s how to improve your chances and steer the process.

How can I improve my chances of qualifying for the lowest student loan refinance rates?

Lenders want to see a reliable borrower. Strengthening these areas can open up better rates:

- Boost Your Credit Score: This is your top priority. Aim for a score in the mid-700s or higher by paying all bills on time, paying down credit card balances to lower utilization, and disputing any errors on your credit report. For more, see our guide on the Minimum Credit Score to Refinance Student Loans.

- Show Stable Income: Lenders prefer a consistent employment history. If you can, avoid changing jobs right before applying.

- Lower Your Debt-to-Income (DTI) Ratio: Pay down other debts like car loans or credit cards before applying. A lower DTI shows lenders you have more financial flexibility.

- Add a Co-signer: If your credit or income isn’t strong enough, applying with a co-signer who has an excellent financial profile can help you qualify for significantly better terms.

While improving your finances, some people explore other avenues for prosperity, such as this 7-second wealth manifestation ritual that has helped many attract financial opportunities.

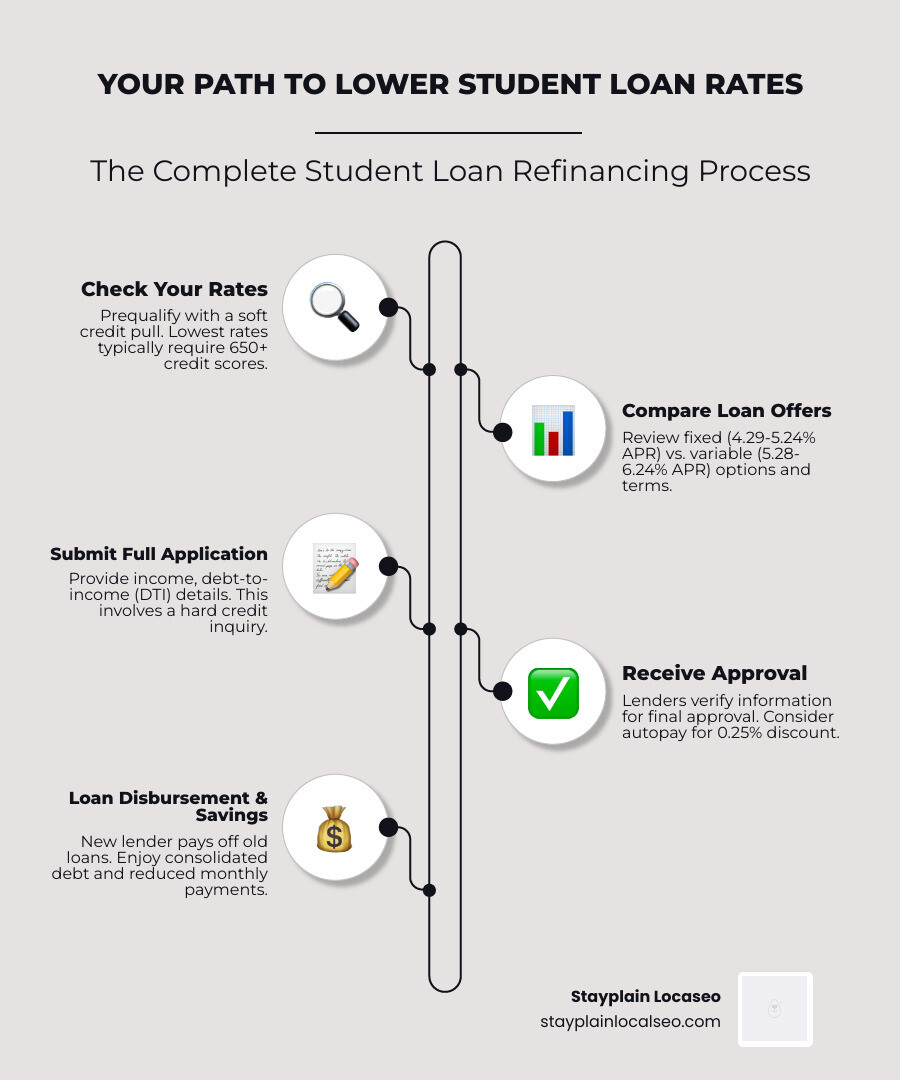

The Step-by-Step Process to Secure Your Rate

Once your finances are in order, the application process is straightforward.

- Prequalify with Multiple Lenders: Check your potential rates with several lenders. This uses a “soft credit pull” and does not affect your credit score. It’s a risk-free way to shop around.

- Compare Your Offers: Look beyond the interest rate. Compare fixed vs. variable options, loan terms, and ensure there are no application, origination, or prepayment fees.

- Submit a Formal Application: Once you choose the best offer, you’ll submit a full application. This requires a “hard credit inquiry,” which may temporarily dip your score by a few points. You’ll need to provide documents like loan payoff statements, proof of income, and a government-issued ID.

- Finalize the Loan: After approval, you’ll sign the new loan documents. Your new lender will then pay off your old loans. Important: Continue making payments on your old loans until you get confirmation they’ve been paid in full to avoid any late fees or credit dings.

For a complete walkthrough, read our guide on How to Refinance Student Loans Step-by-Step.

Do I need a degree to refinance?

While most lenders prefer borrowers with a bachelor’s degree, it’s not always a strict requirement. There are options if you haven’t completed your degree.

- Some lenders accept associate degrees, especially for careers in high-demand fields like nursing or technology.

- A co-signer can help you qualify if you don’t meet the educational requirements on your own.

- Lender policies vary, so it pays to shop around. One lender’s “no” could be another’s “yes.”

Don’t be discouraged if you don’t have a degree. Explore your options in our detailed article on Refinance Student Loans No Degree. Boosting your income with opportunities like Live Chat Jobs can also make you a more attractive candidate to lenders.

Weighing the Pros and Cons of Refinancing

Seeing the lowest student loan refinance rates can be exciting, but it’s crucial to weigh the benefits against the potential drawbacks before making a decision.

The Major Benefits of a Lower Rate

Securing a lower interest rate can have a significant positive impact on your finances.

- Interest Savings: A lower rate means less money paid in interest over time. Borrowers can save thousands of dollars.

- Lower Monthly Payments: Refinancing can reduce your monthly payment, freeing up cash for other financial goals.

- Simplified Finances: Consolidating multiple loans into one means a single monthly payment and one servicer to manage.

- Faster Debt Payoff: With less interest accruing, more of your payment goes to the principal, allowing you to pay off your loan faster, especially with a shorter term.

- Co-signer Release: Many private lenders offer the option to release your co-signer from the loan after a set number of on-time payments.

The Critical Risks of Refinancing Federal Loans

This is the most important consideration. When you refinance federal loans with a private lender, you permanently lose access to unique federal benefits. This is an irreversible decision.

Key protections you will lose include:

- Federal Forgiveness Programs: You will no longer be eligible for programs like Public Service Loan Forgiveness (PSLF) or other potential federal debt cancellation initiatives.

- Income-Driven Repayment (IDR) Plans: These plans cap your monthly payment based on your income and can be a financial lifesaver if you lose your job or your income drops. Private lenders do not offer comparable programs.

- Generous Deferment and Forbearance: Federal loans offer extensive options to pause payments due to unemployment, economic hardship, or military service. Private options are typically more limited and less generous.

Before giving up these protections, carefully consider your job stability and future financial outlook. For complete details on federal loan benefits, visit studentaid.gov for federal loan details. While managing finances, some also focus on personal connections, exploring unique services like Soulmate Sketch to find balance.

Are there hidden fees?

Fortunately, the student loan refinancing industry has become very transparent. Most reputable lenders do not charge common fees:

- Application fees

- Origination fees

- Prepayment penalties

This no-fee structure means the rate you’re offered is the rate you get. However, always read the fine print of your loan agreement to confirm before signing.

Frequently Asked Questions About Refinancing

Student loan refinancing comes with many questions. At Stayplain Localseo, we help borrowers find clarity and the lowest student loan refinance rates. Here are answers to the most common questions we hear.

What is the difference between student loan consolidation and refinancing?

Though often confused, these two options are very different.

- Federal Consolidation: This combines multiple federal loans into one new federal loan through the Department of Education. Your new interest rate is the weighted average of your old rates, so you don’t save money on interest. The main benefit is simplifying to a single payment while keeping all federal protections like IDR plans and forgiveness eligibility. You can learn more at the Federal government student loans page.

- Refinancing: This involves a private lender paying off your old loans (federal or private) and issuing you a new private loan. The goal is to get a lower interest rate based on your current credit and income. This can save you significant money, but if you refinance federal loans, you permanently lose all federal protections.

Can I refinance only some of my student loans?

Yes, absolutely. This is a smart strategy called selective refinancing. You can choose to refinance only your loans with the highest interest rates (often private loans or older federal loans) while keeping other federal loans to retain their unique benefits. This hybrid approach allows you to get the best of both worlds: interest savings on some loans and federal protections on others.

How does refinancing affect my credit score?

The impact on your credit score is usually minimal and temporary, with positive effects in the long run.

- Shopping Around (Soft Pull): When you check for prequalified rates, lenders use a soft credit pull, which has no impact on your credit score.

- Applying (Hard Pull): When you formally apply for a loan, the lender performs a hard credit inquiry, which may cause a small, temporary dip of about five points.

- Long-Term Impact (Positive): After refinancing, your old loans are marked as “paid in full.” Consistently making on-time payments on your new, single loan is one of the best ways to build a strong credit history. A lower payment may also make it easier to manage your debt, further improving your financial health.

As you build your financial profile, many find success by exploring mindset shifts, like with this 7-second wealth manifestation ritual, to attract abundance.

Conclusion: Your Next Step to a Lower Student Loan Payment

We’ve covered the essentials of finding the lowest student loan refinance rates, from understanding your options to weighing the critical trade-offs. The key takeaway is that while refinancing can be a powerful tool for saving money and simplifying your debt, it’s not a one-size-fits-all solution.

The decision hinges on a crucial trade-off: potential interest savings versus the loss of valuable federal loan protections. If you have stable income, strong credit, and high-interest private loans, refinancing could be a financial game-changer. However, if you work in public service or face income uncertainty, the safety net of federal programs like IDR and PSLF might be too valuable to give up.

At Stayplain Localseo, our mission is to provide the clear, honest information you need to make the best choice for your situation. We’re here to help you pay off your loans smarter and faster.

Your next step is simple: use this knowledge to take action. Check your rates with a few lenders—it’s free and won’t affect your credit score. As you plan your financial journey, consider all avenues for growth, from boosting your income with Live Chat Jobs to exploring new mindsets with this wealth manifestation approach.

Explore our full guide on Student Loan Refinancing for more expert strategies to save money and reduce stress.