Why International Student Loan Refinancing Matters

If you’re an international student, you know that paying back student loans can be overwhelming. You often have to deal with currency exchange rates, international banking fees, and fluctuating payments. Refinancing replaces your current student loans with a new loan from a U.S. lender, which can lead to lower interest rates, simplified payments, and the ability to build a U.S. credit history.

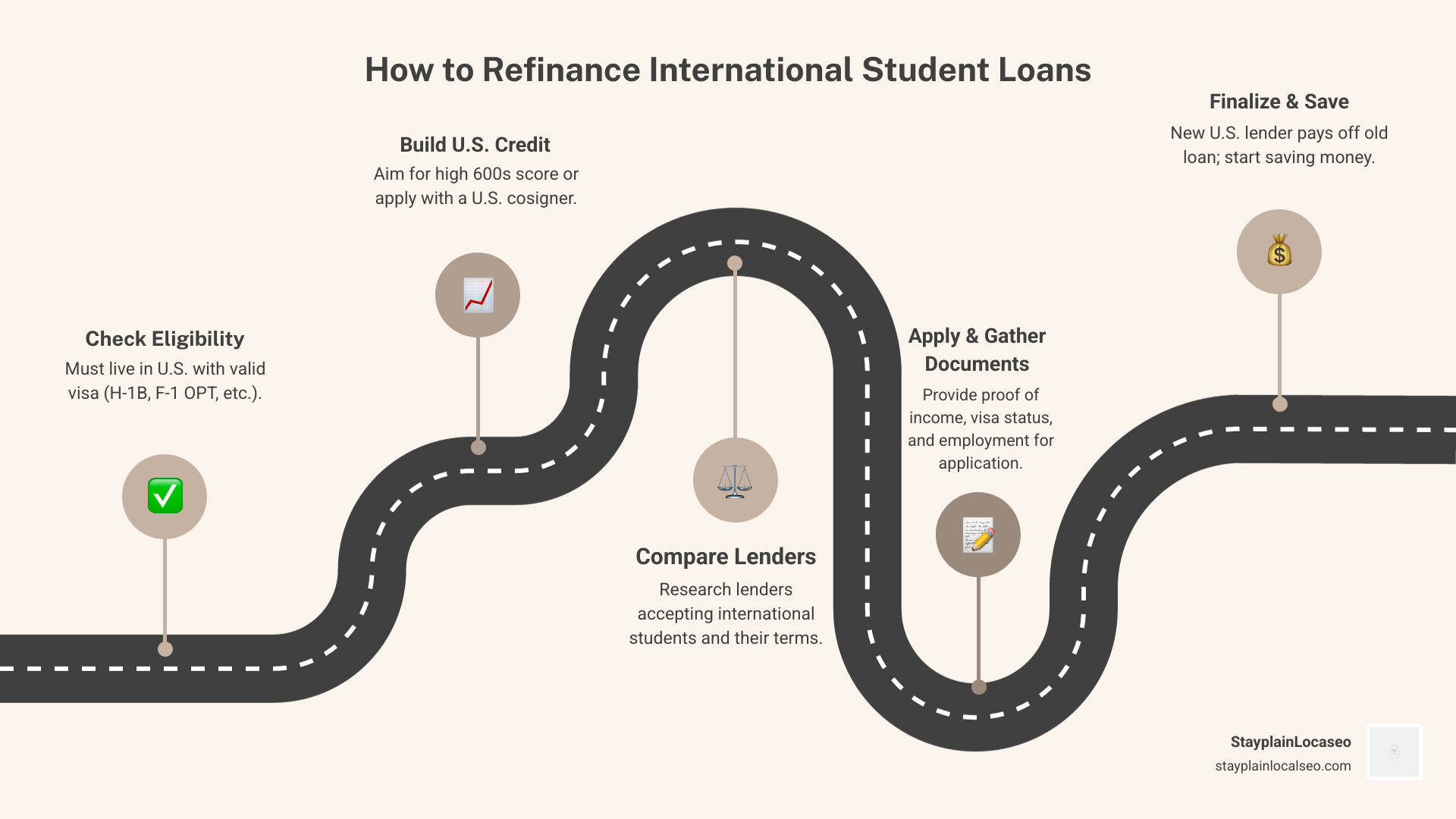

Quick Steps to Refinance International Student Loans:

- Check eligibility – Must live in the U.S. with a valid visa (H-1B, F-1 OPT, etc.)

- Build U.S. credit – Aim for a credit score in the high 600s or find a U.S. cosigner.

- Compare lenders – Look for those that accept international students.

- Gather documents – You’ll need proof of income, visa status, and employment.

- Apply and compare offers – Choose the best rate and terms for your situation.

- Complete the process – The new lender pays off your old loan.

Refinancing can save you thousands of dollars. For example, refinancing a $35,000 loan from 11% to 7.99% interest can save nearly $7,000 over 10 years and reduce monthly payments by $58.

However, refinancing as an international student has unique challenges. Many U.S. lenders only work with U.S. citizens, and you’ll need to steer visa requirements and credit history limitations. This guide breaks down everything you need to know to take control of your financial future.

Why Refinance Your International Student Loans?

Refinancing your international student loans is a smart move for your financial future. It’s not just about swapping loans; it’s about taking control of your money and building a foundation for success in the U.S. By securing a better interest rate, you could save thousands over your loan’s lifetime. You’ll also simplify your payments into one manageable bill, potentially release your cosigner, and start building your U.S. credit history.

What makes refinancing especially powerful for international students is that it transforms complex international payments into a streamlined, U.S.-based loan. This can help you qualify for employer benefits worth up to $5,250 per year, tax-free.

See your potential savings with our Student Loan Refinance Savings Calculator. For those interested in attracting more financial abundance, you might find this interesting: Total Money Magnetism – New Huge Converter.

Secure a Lower Interest Rate

Current U.S. interest rates can be much lower than what you’re paying, especially on loans from your home country. Private education loan rates in the U.S. range from about 4.40% to 12.95%. Refinancing helps you move from the high end of that range to the low end. With fixed vs. variable options, you can choose between predictable payments (fixed) or rates that may start lower but can change (variable).

For example, refinancing a $35,000 loan from 11% to 7.99% interest would save you nearly $7,000 over 10 years. The impact on monthly payments would be a savings of $58 each month, giving you more breathing room in your budget.

Simplify Your Financial Life

Refinancing eliminates the headache of calculating exchange rates and paying international wire transfer fees. You’ll have one U.S.-based payment that’s predictable and straightforward. No more international transfer fees or currency exchange hassles. With a U.S. lender, everything is in dollars, making easier budgeting a reality. Instead of juggling multiple due dates and currencies, you’ll have one simple payment to one lender.

Build U.S. Credit and Gain Independence

Refinancing with a U.S. lender helps you establish U.S. credit history with every on-time payment. Good U.S. credit opens doors to better apartment rentals, car loans, and mortgages. Refinancing can also release family from cosigner obligations, giving them their financial freedom back while you demonstrate your independence.

A key benefit many international students miss is qualifying for employer student loan repayment programs. Many U.S. employers offer up to a $5,250 tax-free employer contribution toward student loans annually. This is free money that can accelerate your loan payoff, but it’s only available for U.S.-based loans.

For those looking to manifest more financial opportunities, you might be interested in this unique approach: PhD Neuroscientist: “This 7-Second Tesla Ritual Attracts Money To You”.

Are You Eligible? Key Requirements for International Students

To understand how to refinance international student loans, you must first meet the eligibility requirements. While the criteria might seem daunting, thousands of international students successfully refinance each year. You don’t need to be a U.S. citizen, but you must meet specific criteria that show your commitment to staying in the U.S. and your ability to repay the loan.

Understanding Visa and Residency Requirements

Your legal status in the U.S. is the foundation of your eligibility. You must reside in the U.S. and hold a valid visa authorizing you to work for an extended period. Lenders need assurance that you’ll remain in the country long enough to repay your loan.

H-1B visa holders often have the easiest path to refinancing. If you’re on an F-1 visa, you’ll need to be in your Optional Practical Training (OPT) or STEM OPT period with active employment. J-1 visa holders may also qualify, though requirements can be stricter.

Other eligible statuses can include E-2, O-1, and TN visas. DACA recipients, refugees, and asylum seekers with valid work authorization are often eligible as well. The common thread is legal work authorization and a clear path to remaining in the U.S.

Crucially, most lenders require at least two years remaining on your current visa or proof that you’ve applied for an extension or permanent residency. This protects both you and the lender. For more information, the State Department’s student visa guide provides comprehensive details.

The Importance of U.S. Credit and Income

Your credit history from your home country doesn’t transfer to the U.S. credit system, so you’re essentially starting from scratch. Most lenders want to see a U.S. credit score in the high 600s or above (often 670+). Our guide on the Minimum Credit Score to Refinance Student Loans breaks down what lenders expect.

Income stability is just as important. Lenders typically require at least three months of consistent, full-time employment in the U.S. after graduation. They are looking for proof that you can handle your monthly payments, which means having a favorable debt-to-income ratio and reliable income.

Meeting these qualifications takes time, but it’s an achievable goal. If you don’t meet all the requirements today, you may qualify in six to twelve months. For those looking to improve their financial situation, resources like Live Chat Jobs can provide additional income opportunities while you build your credit.

How to Refinance International Student Loans: A Step-by-Step Guide

Once you’re eligible, the process of how to refinance international student loans is straightforward. It involves researching lenders, comparing rates, gathering documents, applying, and completing the loan payoff. Each step brings you closer to saving money and simplifying your finances.

For a complete walkthrough, our guide on How to Refinance Student Loans Step-by-Step covers everything. To attract more financial abundance while managing your loans, you might find this interesting: PhD Neuroscientist: “This 7-Second Tesla Ritual Attracts Money To You”.

How to build a U.S. credit history to refinance international student loans

Building U.S. credit is doable with the right strategy. Since your credit history from home doesn’t transfer, you’ll need to establish one here.

- Secured credit cards are a great starting point. You make a deposit that becomes your credit limit. Use the card for small purchases and pay the balance in full each month to show responsible credit use.

- On-time bill payments for rent, utilities, and phone bills are crucial. Some rent reporting services can add your rent payments to your credit file.

- Becoming an authorized user on a credit card of a trusted person with excellent credit can also boost your profile.

- Keep your credit utilization low, ideally under 30% of your credit limit. This shows lenders you can manage credit responsibly.

Building credit takes patience, typically 6 to 12 months to establish a file. Every month of responsible credit use is an investment in your financial future.

Approach 1: Refinancing Without a Cosigner

Refinancing without a cosigner is challenging but possible. Some lenders specialize in working with international students and focus on your future earning potential over a limited U.S. credit history. They’ll look at your academic background, career field, current income, and visa status. You’ll need to demonstrate stability, typically with at least three months of full-time work history post-graduation. Interest rates might be slightly higher than loans with a cosigner, but they can still be a significant improvement over your original loan.

Approach 2: How to refinance international student loans with a U.S. Cosigner

A creditworthy U.S. cosigner is often the key to the best refinancing terms. The benefits include higher approval chances, lower interest rates, and access to more lenders. Your cosigner must be a U.S. citizen or permanent resident with strong credit (typically 670+) and stable income. Many lenders offer cosigner release after 24 to 36 consecutive on-time payments, which removes the cosigner from the loan and gives you and your cosigner peace of mind.

Whether you go it alone or with a cosigner, refinancing is about taking control. For additional income opportunities, check out Live Chat Jobs – You have to try this one. For a unique approach to wealth building, consider WealthGenix – First of its kind: Wealth Manifestation in Physical.

Key Factors to Consider Before You Refinance

Before you decide how to refinance international student loans, it’s crucial to consider several key factors. This decision will impact your finances for years, so it’s important to make a smart choice. For additional income opportunities while managing your loans, explore Live Chat Jobs – You have to try this one.

This table compares a typical home-country loan to a refinanced U.S. loan:

| Feature | Typical Home-Country Loan (Pre-Refinance) | Refinanced U.S. Loan (Post-Refinance) |

|---|---|---|

| Lender Location | Home country | U.S. (private lender) |

| Currency | Home country currency (e.g., INR, CNY) | U.S. Dollars (USD) |

| Interest Rate | Potentially higher; often variable or less favorable | Potentially lower; fixed or variable options |

| Payment Method | International transfers, currency exchange | Direct debit from U.S. bank account |

| Payment Predictability | High variability due to exchange rates | High predictability (especially with fixed rates) |

| Credit Building | Does not build U.S. credit history | Actively builds U.S. credit history |

| Cosigner Requirement | Often required (local or U.S.) | May be required; cosigner release possible |

| Employer Benefits | Ineligible for U.S. employer benefits | Eligible for U.S. employer benefits (up to $5,250 tax-free) |

| Tax Deductibility | Generally not U.S. tax deductible | Potentially U.S. tax deductible (up to $2,500 interest) |

| Loan Term | Varies by country/lender | Typically 5, 7, 10, 15, or 20 years |

| Prepayment Penalties | May exist depending on country/loan type | Generally no prepayment penalties with U.S. private lenders |

Understanding Currency Exchange and Tax Implications

Currency fluctuations can significantly impact your loan payments. For example, the Indian Rupee has devalued against the U.S. dollar over the last two decades, making rupee-denominated loans more expensive to pay back for those earning in dollars. Refinancing into a USD loan can protect you from this risk. Conversely, currencies like the Chinese Yuan have strengthened, potentially making home-country loans cheaper to repay. It’s important to do the math for your specific situation.

On the tax front, refinancing in the U.S. could make you eligible to deduct up to $2,500 in student loan interest annually. Your lender will provide Form 1098-E for your tax return. For more details, see the IRS guide at irs.gov/taxtopics/tc456.

Refinancing vs. Consolidation: What’s the Difference?

It’s important to distinguish between refinancing and consolidation. Refinancing means getting a new loan with a private lender to pay off your old ones, ideally with a better interest rate and terms. Consolidation usually refers to the federal Direct Loan Consolidation Program, which combines multiple federal loans into one. The interest rate is a weighted average of the original rates, so it doesn’t typically save you money. Since most international students don’t have federal loans, you’ll almost always be looking at refinancing with a private lender.

Potential Risks and Downsides

Be aware of the potential risks before you refinance:

- You might not qualify for a better rate if your credit isn’t strong enough or if market rates have risen.

- You could lose benefits from your original loan, such as generous deferment options.

- Variable rates can be unpredictable and may increase over time, raising your payments.

- Your credit score may take a small, temporary dip from the hard credit inquiry when you apply.

Refinancing is a powerful tool, but do your homework to ensure it’s the right move for you. For those looking to manifest better financial outcomes, explore WealthGenix – First of its kind: Wealth Manifestation in Physical.

Frequently Asked Questions about Refinancing International Student Loans

Here are answers to common questions about how to refinance international student loans.

Can I refinance my student loans if I’m on an F-1 visa?

Yes, it’s possible to refinance on an F-1 visa, especially if you are on Optional Practical Training (OPT) or STEM OPT and have a job. Lenders will need to see your work authorization, stable income, and typically require at least two years remaining on your visa. Being on OPT strengthens your application by showing lenders that you’re transitioning into your professional career.

What credit score do I need to refinance international student loans?

Most lenders prefer a U.S. credit score of 670 or higher. Since your credit history from your home country doesn’t transfer, you’ll be starting fresh in the U.S. If you don’t have sufficient U.S. credit history, your two main options are to spend 6-12 months building your credit or to apply with a creditworthy U.S. citizen or permanent resident as a cosigner. Some specialized lenders may be more flexible, considering your earning potential in addition to your credit score.

For those interested in attracting more financial abundance while building credit, you might find value in exploring Cosmic Wealth Code: Breakthrough Manifestation Offer, Commission Magnet.

Can I refinance a loan from my home country with a U.S. lender?

Yes, many U.S. lenders can refinance education loans that were originally taken out in another country. The new U.S. lender pays off your foreign loan directly, and you begin making payments to them in U.S. dollars. This eliminates the hassles of international wire transfers, fluctuating exchange rates, and currency conversion fees. You will need to provide documentation of your original loan terms and balance. This switch can also make you eligible for U.S. tax deductions and employer benefits that weren’t available with your foreign loan.

If you’re looking to manifest greater financial success during this transition, consider exploring WealthGenix – First of its kind: Wealth Manifestation in Physical for additional support on your wealth-building journey.

Take Control of Your Financial Future

You now have a complete guide on how to refinance international student loans. You have a clear roadmap to move from dealing with complicated international payments to a simplified, beneficial U.S.-based loan. Refinancing can save you thousands, build your U.S. credit history, and make you eligible for valuable employer student loan benefits that can provide up to $5,250 in tax-free assistance annually.

This journey requires patience. Building U.S. credit takes time—typically 6 to 12 months or more. It’s also important to consider currency exchange rates. If your home country’s currency has weakened against the dollar (like the Indian Rupee), refinancing into USD can protect you. If it has strengthened, you’ll want to calculate whether refinancing still makes financial sense.

At Stayplain Localseo, our mission is simple: help you pay off your student loans smarter and faster. We’re here to provide the tools and guidance you need.

Don’t let student debt hold you back from the future you’ve worked so hard to build. Getting your student loans optimized is a crucial first step toward achieving your financial goals, whether that’s buying a home, starting a family, or launching a business.

Ready to start? Check your eligibility, compare rates from multiple lenders, and see your potential savings. Explore our Student Loan Refinancing resources to get started.

While working on your financial goals, you might also be interested in other paths to abundance. For wealth-building, check out WealthGenix – First of its kind: Wealth Manifestation in Physical. If you’re looking for flexible work, Live Chat Jobs – You have to try this one offers income opportunities. For those interested in the spiritual side of abundance, Spiritual Salt: Brand New Spirituality Offer, High-Conversion Machine might resonate with you.

Your financial future is in your hands. Take the first step today.