Why Bad Credit Doesn’t Have to Block Your Student Loan Refinancing Goals

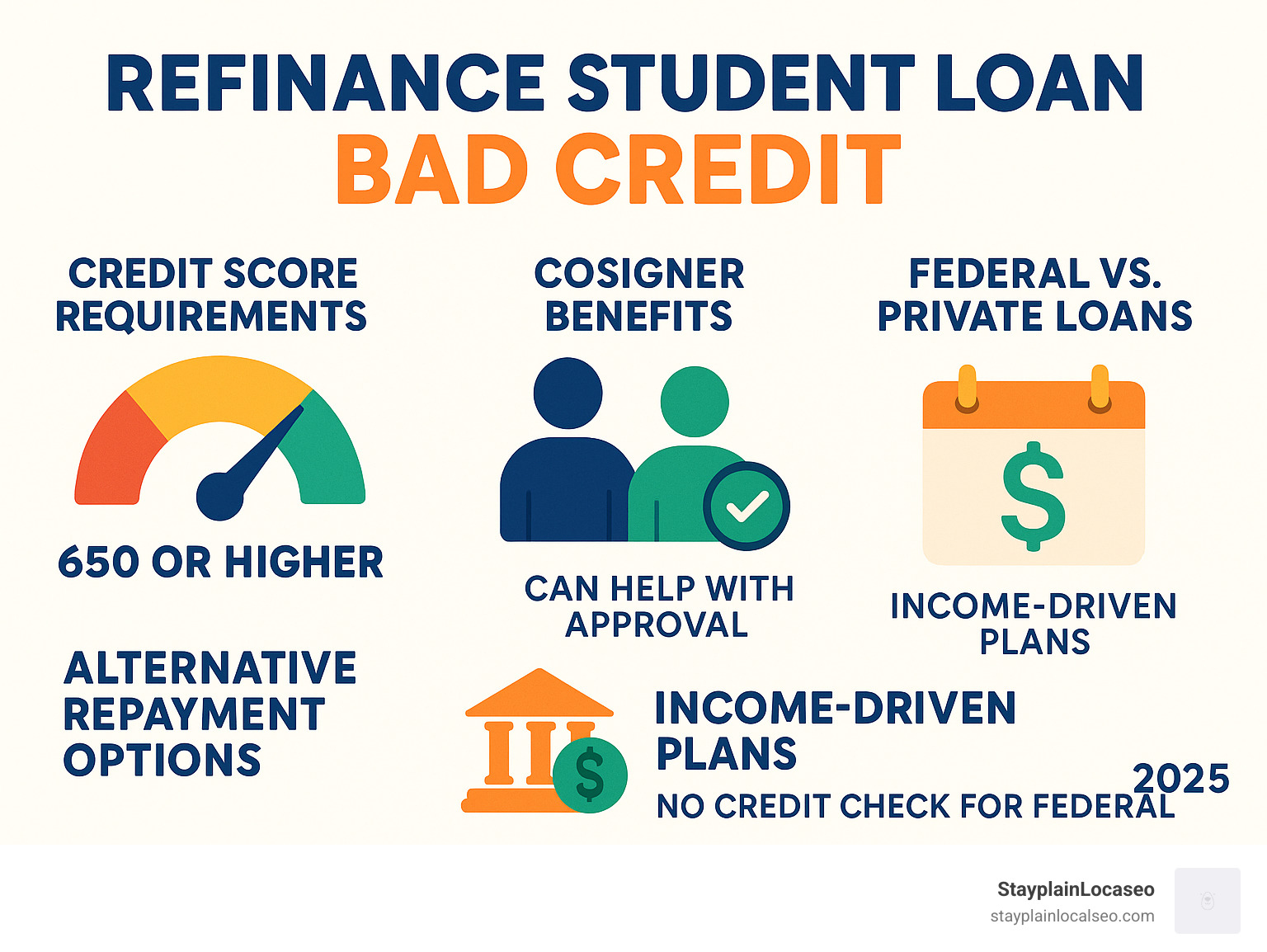

Refinance student loan bad credit options exist, even when your credit score feels like a roadblock. Here’s what you need to know right away:

Quick Solutions for Bad Credit Student Loan Refinancing:

- Apply with a cosigner who has good credit (most effective option)

- Improve your credit score by paying bills on time and reducing debt

- Shop around with multiple lenders – requirements vary significantly

- Consider federal consolidation instead (no credit check required)

- Explore income-driven repayment plans as an alternative

Most lenders prefer a credit score of 650 or higher for student loan refinancing. With poor credit, you might still qualify but expect higher interest rates – potentially in the double digits.

The reality is tough but not hopeless. If you’re drowning in student loan payments and your credit history isn’t perfect, you’re facing a common challenge. More than 44 million borrowers owe $1.59 trillion in student loan debt, and many struggle with less-than-ideal credit scores.

Bad credit makes refinancing harder, but it doesn’t make it impossible. Some lenders specialize in working with borrowers who have credit challenges. Others look beyond your credit score to factors like your income, employment history, and debt-to-income ratio.

This guide will show you exactly how to steer student loan refinancing with bad credit. We’ll cover proven strategies to improve your approval odds, alternative options when refinancing isn’t possible, and how to avoid losing valuable federal loan protections.

The key is understanding your options and choosing the right strategy for your situation.

Essential Refinance student loan bad credit terms:

Understanding How to Refinance Student Loans with Poor Credit

Let’s break down what happens when you want to refinance student loan bad credit situations. Think of it as getting a financial do-over, but with some important catches you need to understand first.

What Does It Mean to Refinance Student Loans with Poor Credit?

When you refinance your student loans, you’re essentially asking a private lender to give you a brand new loan that pays off all your existing student debt. It’s like consolidating everything into one neat package with a single monthly payment to one lender.

The dream scenario? You land a lower interest rate that saves you thousands over the years. Maybe you also get payment terms that fit your budget better.

But here’s where bad credit throws a wrench in the works. Lenders look at your credit score like a report card for your financial reliability. A low score makes them nervous about lending to you money. They might still say yes, but they’ll probably charge you more for the privilege.

It’s a bit like trying to rent an apartment with a sketchy rental history – you might get approved, but you’ll likely pay a higher security deposit. The same logic applies when you refinance student loan bad credit scenarios.

For a deeper dive into the basics, check out our comprehensive guide on Refinance Student Loans Bad Credit.

Pros and Cons of Student Loan Refinancing for Bad Credit Borrowers

Before you jump into refinancing with less-than-perfect credit, let’s talk about what you’re getting into. The decision isn’t always black and white.

On the bright side, refinancing can offer some real benefits. Even with bad credit, you might still snag a lower interest rate than what you’re currently paying, especially if you bring a cosigner to the table. You could also choose a different repayment term – maybe stretch it out for lower monthly payments or compress it to pay less interest overall. Plus, having just one monthly payment instead of juggling multiple loans can seriously simplify your financial life.

But here’s where things get tricky, especially if you have federal student loans. Refinancing federal loans with a private lender means losing federal protections that could be lifesavers down the road.

Those income-driven repayment plans that adjust your payments based on what you actually earn? Gone. Loan forgiveness programs like Public Service Loan Forgiveness that could wipe out your remaining balance after years of qualifying payments? Also gone. The generous deferment and forbearance options that let you pause payments during tough times? You guessed it – those disappear too.

It’s like trading in a Swiss Army knife for a regular knife. The regular knife might be sharper, but you’re giving up a lot of useful tools in the process.

You can learn more about what you’d be giving up at the official federal student aid website.

What Credit Score Is Needed to Refinance Student Loans?

Most lenders want to see a credit score in the mid-to-high 600s before they’ll even consider your application. The magic number that opens most doors? Around 650 or higher.

If your score falls below this benchmark, you’re not automatically out of luck, but you’re definitely swimming upstream. Lenders might still approve you, but expect to see interest rates that could make you wince – we’re talking potentially double-digit APRs.

Here’s the thing though: your credit score isn’t the only thing lenders care about. They’re also looking at your debt-to-income ratio to see how much of your monthly income already goes to debt payments. They want to see stable employment and consistent income. Some even peek at your banking habits to get a sense of how you manage money day-to-day.

The good news? Even if your credit isn’t perfect right now, there are strategies to improve your situation. We’ll cover those in the next section, but first, you might want to read our detailed breakdown of Minimum Credit Score to Refinance Student Loans to understand exactly where you stand.

When you refinance student loan bad credit situations, knowledge is your best weapon. Understanding these fundamentals puts you in a much better position to make smart decisions about your financial future.

How to Refinance Student Loans with Bad Credit: Strategies for Success

When you’re facing the challenge of refinance student loan bad credit, it might feel like you’re stuck between a rock and a hard place. But here’s the encouraging truth: with the right approach and some strategic moves, you can dramatically improve your chances of getting approved and securing terms that actually help your financial situation.

Think of this as your game plan for turning things around. We’ve seen countless borrowers transform their refinancing prospects by following these proven strategies.

Strategy 1: Boost Your Credit and Financial Profile for Student Loan Refinancing

The most powerful thing you can do is strengthen your overall financial picture. It’s like preparing for a job interview – the better you look on paper, the more likely you are to get the “yes” you’re hoping for.

Start by getting your credit report from AnnualCreditReport.com and examining it with a magnifying glass. You’d be surprised how often we find errors that are dragging down scores unnecessarily. Maybe there’s a late payment that was actually made on time, or an account that doesn’t belong to you. Dispute these errors immediately – it’s free money in your pocket when your score improves.

Your payment history is the heavyweight champion of credit scoring, making up 35% of your FICO score. Every single bill you pay on time – student loans, credit cards, even your cell phone – helps build that positive track record. Set up automatic payments if you’re forgetful. Missing a payment because you were busy is like leaving money on the table.

Credit utilization is your next big opportunity. This fancy term just means how much of your available credit you’re actually using. Keep your credit card balances below 30% of your limits, but shooting for under 10% is even better. If you have a $1,000 credit limit, try to keep your balance under $100. Paying down existing credit card debt can give your score a surprisingly quick boost.

Your debt-to-income ratio matters just as much to lenders as your credit score. They want to see that you’re not drowning in monthly payments. You can improve this by either paying down existing debts or finding ways to increase your income. Even a weekend side gig can make a meaningful difference in how lenders view your application.

Sometimes, a shift in mindset about money can open doors you didn’t even know existed. We’ve found that some people benefit from exploring different perspectives on financial abundance, like the approach described in PhD Neuroscientist: “This 7-Second Tesla Ritual Attracts Money To You”.

Strategy 2: Use a Creditworthy Cosigner to Refinance Student Loans

If improving your credit feels like it’ll take forever, a cosigner can be your shortcut to better loan terms. Think of them as your financial wingman – someone whose good credit helps you get into the club you couldn’t access on your own.

A cosigner essentially vouches for you with the lender. Their excellent credit history, stable job, and low debt levels reduce the risk for the lender, which translates into better rates and higher approval odds for you. It’s like having someone with a stellar reputation introduce you at a networking event.

The ideal cosigner has a credit score above 700, steady employment with verifiable income, and a debt-to-income ratio that shows they’re managing their finances well. They should also have a clean credit history without recent bankruptcies or major credit issues.

But let’s be real about the commitment you’re asking of them. Your cosigner becomes legally responsible for the loan right alongside you. If you miss payments, their credit score takes a hit, and they’re on the hook for the entire debt. This isn’t a casual favor – it’s a serious financial partnership.

The good news is that most lenders offer cosigner release options. After you make a certain number of consecutive on-time payments (usually 12 to 48 months) and meet specific credit and income requirements, your cosigner can be removed from the loan. Make sure any lender you consider offers this feature.

Finding extra income can strengthen both your application and your cosigner’s confidence in your ability to repay. If you’re looking for flexible work opportunities, platforms like Live Chat Jobs – You have to try this one offer ways to earn money on your own schedule.

Strategy 3: Compare Lenders and Offers for Bad Credit Student Loan Refinancing

Here’s where many borrowers make a costly mistake – they apply with the first lender they find instead of shopping around. Different lenders have vastly different standards for refinance student loan bad credit applications, and what one rejects, another might approve.

Credit unions often take a more personal approach to lending decisions. If you’re already a member, they might consider factors beyond just your credit score, like your banking history with them or your employment situation. They’re often more willing to work with borrowers who have credit challenges.

Specialized online lenders sometimes focus specifically on borrowers with less-than-perfect credit. These companies understand that a credit score doesn’t tell your whole financial story. They might look at your education, career field, or recent financial improvements that traditional lenders overlook.

Always start with prequalification before submitting formal applications. This involves a soft credit check that doesn’t impact your credit score but gives you estimated rates and terms. It’s like window shopping – you can see what’s available without any commitment or consequences.

When you’re comparing offers, don’t get tunnel vision on just the interest rate. Look at the complete package: repayment terms, any fees (ideally none), forbearance options if you hit financial trouble, and whether they offer cosigner release. A slightly higher rate with better borrower protections might be worth it.

Gather your paperwork ahead of time to streamline the application process. You’ll typically need recent pay stubs, tax returns, statements for all the loans you want to refinance, and a government-issued ID. Having everything organized shows lenders you’re serious and prepared.

For a detailed walkthrough of the entire process, check out our comprehensive guide on How to Refinance Student Loans Step-by-Step.

Sometimes, taking control of your financial future requires thinking outside the box and believing in possibilities you haven’t considered yet. Some people find inspiration in creative approaches to manifesting their goals, like those explored in Soulmate Sketch. Over $2,000,000 Paid to Affiliates. It Just Converts.

Every lender rejection isn’t a personal judgment – it’s just one company’s criteria. Keep shopping, keep improving your financial profile, and keep believing that better loan terms are within reach.

Alternatives to Student Loan Refinancing for Bad Credit Borrowers

Sometimes, even with your best efforts, refinance student loan bad credit options just don’t work out. Maybe the interest rates are still too high, or perhaps you can’t find a cosigner. Don’t worry – you’re not out of options! In fact, if you have federal student loans, you might have access to some pretty amazing alternatives that could work even better than refinancing.

The key is understanding what’s available to you. Federal loans come with a whole toolkit of benefits that private refinancing simply can’t match. Let’s explore these alternatives that don’t care one bit about your credit score.

Federal Direct Consolidation Loan: An Option for Bad Credit

Here’s some great news: if you have multiple federal student loans, you can combine them through a Direct Consolidation Loan without any credit check whatsoever. Your credit score could be in the basement, and it wouldn’t matter one bit to this program.

How Federal Consolidation Actually Works:

Think of consolidation as bundling all your federal loans into one neat package. The government takes all your existing federal loans, pays them off, and creates one brand-new federal loan. Your new interest rate becomes the weighted average of all your old rates, rounded up to the nearest one-eighth of a percent.

It’s like taking five different puzzles and combining all the pieces into one big puzzle – same pieces, just organized differently.

The Real Benefits and Drawbacks:

The biggest advantage is simplification. Instead of juggling multiple payments to different servicers, you’ll have just one monthly payment. Plus, you keep all those valuable federal protections we talked about earlier – income-driven repayment plans, forgiveness programs, and generous deferment options.

But here’s the catch: you won’t save money on interest. Since the rate is just an average of your existing rates (plus a tiny bit extra from rounding), your monthly payment might not change much. Think of it as reorganizing your debt rather than reducing it.

There’s one important warning: if you’re already working toward loan forgiveness through programs like Public Service Loan Forgiveness, consolidation can reset your payment counter to zero. That’s a big deal if you’ve already made years of qualifying payments!

Income-Driven Repayment (IDR) Plans for Federal Student Loans

If your federal loan payments feel impossible to manage, Income-Driven Repayment plans might be your financial lifesaver. These plans are designed specifically for borrowers who are struggling, and they don’t care about your credit score – only your income.

Who Can Use IDR Plans and How They Calculate Payments:

IDR plans are exclusively for federal student loans. Your monthly payment gets calculated based on a percentage of your discretionary income and your family size. If you’re barely making ends meet, your payment could be as low as $0 per month. Yes, you read that right – zero dollars!

The government looks at what you earn, subtracts a living allowance based on federal poverty guidelines, and then takes a percentage of what’s left. It’s like having a payment plan that actually understands your real financial situation.

Why IDR Plans Can Be Game-Changers:

The most obvious benefit is affordable payments that adjust with your income. Lost your job? Your payments can drop. Got a raise? They’ll increase, but proportionally to what you can actually afford.

But here’s the really exciting part: after 20 to 25 years of payments (depending on your specific plan and loan types), any remaining balance gets completely forgiven. For borrowers with high debt-to-income ratios, this can mean significant savings over time.

Some newer IDR plans, like the SAVE plan, even offer interest subsidies. This means if your monthly payment doesn’t cover all the interest that’s accruing, the government steps in to pay the difference. Your loan balance won’t grow like a monster under the bed!

Deferment and Forbearance: Temporary Relief for Student Loan Payments

Sometimes you just need to hit the pause button on your student loan payments. Federal loans offer deferment and forbearance options that can provide breathing room during tough times.

What These Options Provide:

Both deferment and forbearance allow you to temporarily pause or reduce your payments during qualifying events like financial hardship, unemployment, returning to school, or military service. It’s like having an emergency brake for your student loan payments.

The difference between them is mainly administrative – deferment is for specific qualifying situations (like unemployment or economic hardship), while forbearance gives your loan servicer more discretion to help you based on your individual circumstances.

The Important Catch You Need to Know:

Here’s what many borrowers don’t realize: interest usually keeps accruing while your payments are paused. This is especially true for unsubsidized loans, PLUS loans, and any private loans you might have. Your loan balance can actually grow during this time, which means you’ll owe more when you restart payments.

Think of it like pausing a movie – the story stops, but time keeps ticking. These options are fantastic for short-term relief, but they’re not long-term solutions to high payments or interest rates.

When These Make the Most Sense:

Deferment and forbearance work best when you’re facing a temporary setback – like job loss, medical issues, or a major life change – and you expect your financial situation to improve relatively soon. They buy you time to get back on your feet without defaulting on your loans.

For more comprehensive strategies on managing all aspects of your student loan debt, including these alternatives, check out our detailed guide on Student Loan Debt Management.

These federal alternatives offer flexibility and protections that private refinancing simply cannot match. Sometimes the best financial strategy isn’t about getting the lowest interest rate – it’s about finding the approach that gives you the most security and options for your unique situation. When you’re exploring all your financial options, some people find that shifting their mindset about money can open up new possibilities, which is why resources like Shifting Vibrations: Manifestation Offer From CB Platinum Plus Vendor have gained popularity among those looking to improve their overall financial well-being.

Conclusion: Smarter Student Loan Repayment with Bad Credit

Managing student loan debt when your credit isn’t perfect can feel like trying to solve a puzzle with missing pieces. But here’s what we’ve learned together – refinance student loan bad credit options do exist, and you have more power than you might think to improve your situation.

Throughout this guide, we’ve walked through the most effective strategies for tackling student loan refinancing with less-than-perfect credit. Improving your credit score remains your strongest long-term weapon – focusing on consistent, on-time payments and reducing your credit utilization can open doors you didn’t know existed. Sometimes, shifting your mindset about money can also create unexpected opportunities, which is why resources like Shifting Vibrations: Manifestation Offer From CB Platinum Plus Vendor have helped some people transform their financial perspective.

Using a creditworthy cosigner can be your immediate game-changer, essentially borrowing their good credit to open up better rates and approval odds. Just remember, this is a serious commitment for both of you. Shopping around with multiple lenders isn’t just smart – it’s essential. Credit unions, online lenders, and specialized platforms each have different appetites for risk, and what one lender rejects, another might welcome.

But here’s something crucial we want you to remember: refinancing isn’t your only path forward. Federal consolidation loans require no credit check and keep all your valuable federal protections intact. Income-driven repayment plans can slash your monthly payments to zero if your income is low enough, and they come with built-in forgiveness after 20-25 years. Even temporary deferment or forbearance can give you breathing room when life throws you a curveball.

The key to making the right choice lies in understanding what matters most for your unique situation. If you’re primarily focused on reducing interest costs and have stable income, refinancing might be worth exploring. If you value the safety net of federal protections or work in public service, keeping your federal loans might be the wiser path.

We’ve seen countless borrowers transform their financial situations by taking small, consistent steps. Building wealth isn’t just about managing debt – it’s about creating the right mindset and habits. Resources like Total Money Magnetism – New Huge Converter have helped many people develop a healthier relationship with money, while practical tools like Course Creator System, – Upsell Four Products On Funnel To Promote can help you explore additional income streams.

At Stayplain Localseo, we’re not just here to help you steer student loan refinancing – we’re here to help you build a stronger financial future. Every small step you take today, whether it’s disputing a credit report error or making an extra payment toward your highest-interest debt, moves you closer to financial freedom.

Your credit score today doesn’t define your financial future. With patience, persistence, and the right strategies, you can turn your student loan burden into a manageable part of your financial journey.

Explore our expert guides on personal finance to continue building your financial knowledge and confidence. We’re here to help you pay off your student loans smarter and faster – one informed decision at a time.