Why Student Loan Expert Advice Can Transform Your Financial Future

Student loan expert advice is essential for the 45 million Americans carrying $1.7 trillion in student debt. With complex repayment options, forgiveness programs, and refinancing decisions, getting the right guidance can save you thousands of dollars and years of payments.

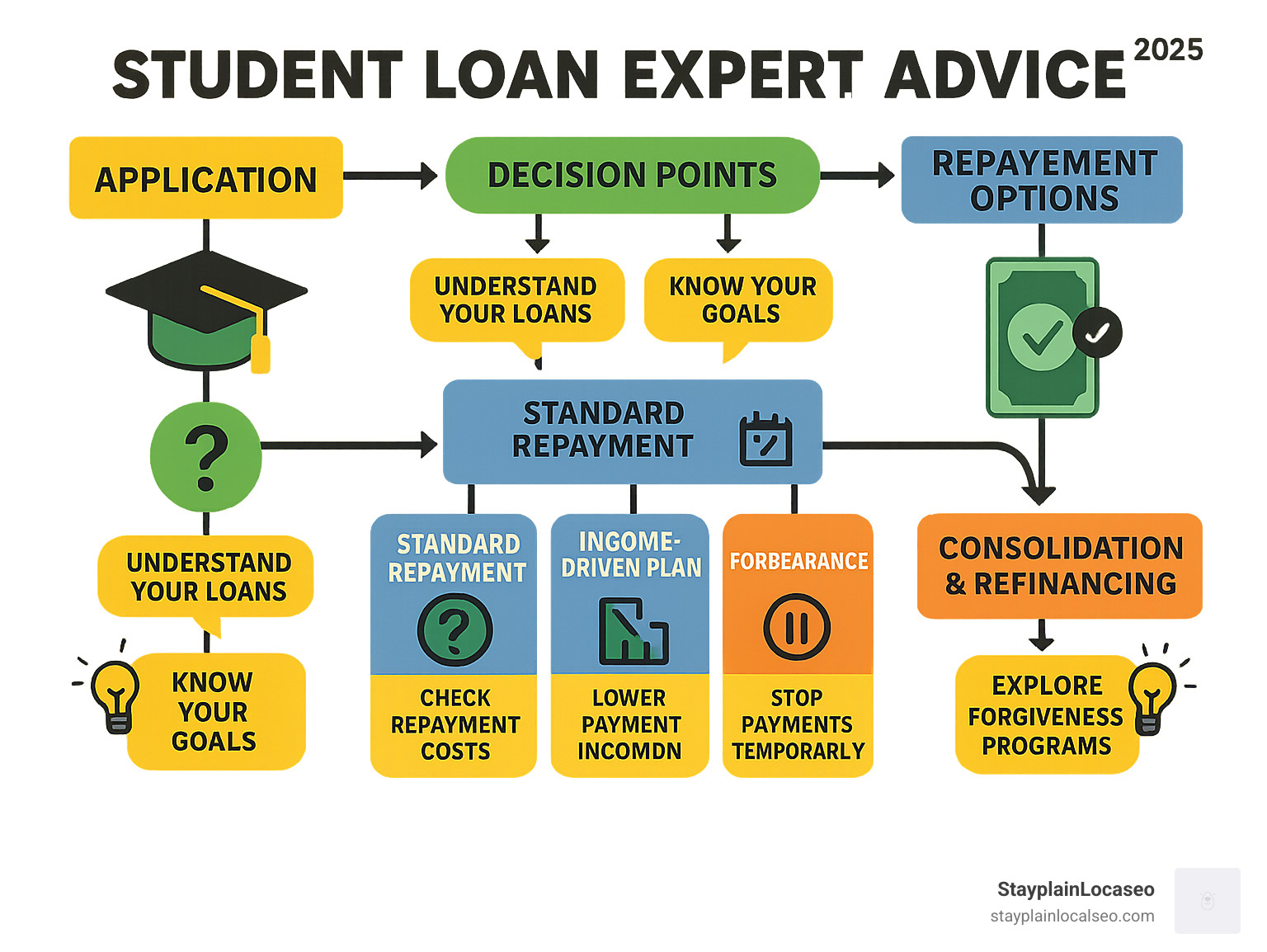

Quick Expert Advice Summary:

- Start with your loan servicer – They’re your first point of contact for free help

- Explore income-driven repayment plans – Can reduce payments to as low as $0/month

- Check forgiveness eligibility – PSLF and other programs can eliminate remaining debt

- Consider refinancing carefully – Private loans lose federal protections

- Avoid scams – Never pay upfront fees for loan forgiveness help

- Get professional help for complex situations – Certified advisors can create custom strategies

The student loan landscape has become incredibly complex. As Michael Liersch from Wells Fargo notes: “Just as most people can’t buy a home without a mortgage, most people can’t go to college without borrowing.” Yet unlike mortgages, student loans come with dozens of repayment options, multiple forgiveness programs, and constantly changing regulations.

The stakes are high. Research shows that 90% of borrowers who get expert consultation save an average of $53,000 over their loan’s lifetime. Meanwhile, those who make uninformed decisions often end up paying far more than necessary – or worse, falling into default.

This isn’t about complex financial theory. It’s about understanding your options and making smart choices that fit your situation. Whether you owe $20,000 or $200,000, the right strategy can dramatically reduce your burden and accelerate your path to financial freedom.

The good news? You don’t need to figure this out alone. From free government resources to certified student loan professionals, expert help is available. The key is knowing where to look and what questions to ask.

Understanding Your Student Loan Options: Student Loan Expert Advice for Borrowers

Before we dive into repayment strategies, it’s crucial to understand the different types of student loans available. Knowing what you have is the first step toward effective management. We’ll help you steer the various options, from federal loans with their unique benefits to private loans that often come with different terms.

There are two primary categories of student loans: federal and private.

Federal Direct Loans: These are issued by the U.S. Department of Education and come with various borrower protections and benefits.

- Direct Subsidized Loans: Available to undergraduate students with demonstrated financial need. The government pays the interest while you’re in school at least half-time, during your grace period, and during deferment.

- Direct Unsubsidized Loans: Available to undergraduate and graduate students, regardless of financial need. Interest accrues from the moment the loan is disbursed, even while you’re in school.

- Direct PLUS Loans: Available to graduate or professional students (Grad PLUS) and parents of dependent undergraduate students (Parent PLUS). These require a credit check and generally have higher interest rates than subsidized or unsubsidized loans, but still offer federal protections.

Private Student Loans: These are offered by banks, credit unions, and other private lenders. They typically have fewer borrower protections than federal loans and often require a credit check and/or a co-signer. Their terms, interest rates, and fees can vary widely depending on the lender and your creditworthiness.

Understanding your specific loan details, including your loan servicer, interest rates, and grace periods, is vital. You can find information on your federal loans by logging into your My Federal Student Aid account.

Key Differences: Federal vs. Private Student Loans – Student Loan Expert Insights

The distinctions between federal and private student loans are significant and should heavily influence your repayment strategy. We’ve broken down the key differences to provide you with clear student loan expert advice.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Fixed rates set by Congress, often lower | Can be fixed or variable, often higher, based on credit |

| Borrower Protections | Income-driven repayment plans, deferment, forbearance, forgiveness programs | Limited or no borrower protections |

| Forgiveness Options | PSLF, IDR forgiveness, Teacher Loan Forgiveness, etc. | Very rare, usually only in extreme circumstances (e.g., death) |

| Repayment Flexibility | Multiple plans, including income-driven, grace periods, deferment, forbearance | Fewer options, typically standard repayment, limited grace periods |

| Credit Check | Generally not required for most (except PLUS loans) | Almost always required, often needs a co-signer |

Federal loans offer a safety net that private loans simply don’t. While private loans might offer competitive rates for borrowers with excellent credit, they lack the flexible repayment options and potential for forgiveness that federal loans provide. This is why we generally advise exhausting federal loan options before considering private loans.

The Role of Your Student Loan Servicer: Student Loan Expert Guidance

Your student loan servicer plays a critical role in managing your debt. Think of them as the customer service arm of your loan. For federal loans, your servicer is the company that handles your billing, processes your payments, and provides information on your account.

Their responsibilities include:

- Payment Processing: Ensuring your payments are correctly applied to your account.

- Repayment Plan Enrollment: Helping you apply for and enroll in various federal repayment plans, including income-driven options.

- Answering Questions: Providing information about your loan balance, interest rates, payment history, and available options.

- Dispute Resolution: Assisting with any discrepancies or issues you might have with your loan.

Your servicer should be your first point of contact for any questions or issues regarding your student loans. However, as some borrowers have experienced, servicer inconsistencies and long hold times can be frustrating. While they are a crucial resource, it’s always wise to educate yourself and double-check information.

Navigating Repayment Plans: Student Loan Expert Advice for Managing Debt

Once you understand your loans, the next crucial step is choosing the right repayment plan. This decision can literally save you thousands of dollars and countless sleepless nights. Think of it as choosing the right path up a mountain – there are multiple routes, but picking the one that matches your fitness level and goals makes all the difference.

Federal student loans offer several repayment options designed to fit different financial situations. The beauty of federal loans is this flexibility – something private loans rarely match.

The Standard Repayment Plan is the default option that gets you debt-free fastest. Your payments stay the same for 10 years (or up to 30 years for consolidated loans), and you’ll pay the least total interest over time. It’s like ripping off a band-aid – painful at first, but over quickly.

If you need payments to start smaller, the Graduated Repayment Plan might be your friend. Payments begin low and bump up every two years over a 10-year period. This works beautifully if you’re fresh out of college and expect your salary to grow. Think of it as training wheels for your career earnings.

For borrowers juggling more than $30,000 in federal loans, the Extended Repayment Plan stretches payments over up to 25 years. Your monthly burden drops significantly, but you’ll pay more interest overall. It’s a trade-off between breathing room now and total cost later.

Sometimes life throws curveballs, and that’s where forbearance and deferment come in. Forbearance lets you temporarily pause or reduce payments for up to 12 months at a time, though interest usually keeps ticking. Deferment works similarly but may not charge interest on subsidized loans if you meet specific criteria like unemployment or returning to school.

Many borrowers find that managing student debt becomes much easier when they also focus on their overall financial wellness. Some explore unique approaches to building wealth, like the strategies outlined in PhD Neuroscientist: “This 7-Second Tesla Ritual Attracts Money To You”, which offers a fresh perspective on attracting financial abundance.

The key is matching your repayment plan to your current reality while keeping an eye on your future goals. Student loan expert advice consistently emphasizes that there’s no one-size-fits-all solution – what works for your roommate might be completely wrong for you.

Decoding Income-Driven Repayment (IDR) Plans: Student Loan Strategies for Lower Payments

Here’s where federal student loans really shine. Income-Driven Repayment plans are absolute game-changers for borrowers whose debt feels overwhelming compared to their income. These plans cap your monthly payment based on what you actually earn, not what you owe.

The magic number? Your payment could drop to as low as $0 per month if your income is low enough. And here’s the kicker – after 20 or 25 years of qualifying payments, any remaining balance gets forgiven. It’s like having a safety net with a built-in escape hatch.

The SAVE Plan is the newest kid on the block and often the most generous. It protects more of your income from payment calculations, meaning you keep more money in your pocket. For undergraduate loans, you’ll pay just 5% of your discretionary income (10% for graduate loans). Even better, if you make your required payment – even if it’s $0 – your loan balance won’t grow from unpaid interest.

The PAYE Plan and IBR Plan both cap payments at 10% of discretionary income for most borrowers, though IBR might be 15% if you borrowed before 2014. These plans have helped millions of borrowers avoid default and maintain their financial sanity.

The ICR Plan is the grandfather of income-driven plans, capping payments at 20% of discretionary income. While not as generous as newer options, it’s available to all federal borrowers and includes Parent PLUS loans through consolidation.

We strongly encourage exploring the government’s updated income-driven repayment options to find your best fit. The government’s website walks you through each option and even estimates your payments.

These plans work especially well if you’re in public service, non-profit work, or any career where passion matters more than paycheck size. They’re also perfect for borrowers whose income fluctuates or who are building their careers.

Many successful borrowers combine IDR plans with side income strategies. Some explore opportunities like Live Chat Jobs – You have to try this one to boost their earnings while keeping payments manageable. Others focus on wealth-building approaches such as Total Money Magnetism – New Huge Converter to create multiple income streams.

Choosing an IDR plan isn’t set in stone. You can switch plans annually or whenever your financial situation changes. The key is staying proactive and reassessing your strategy as your life evolves.

Opening Up Student Loan Forgiveness and Relief: Expert Advice for Borrowers

Student loan forgiveness might sound too good to be true, but it’s a genuine opportunity that has helped thousands of borrowers eliminate their debt completely. The key is understanding which programs you qualify for and following the rules precisely.

Public Service Loan Forgiveness (PSLF) is the most well-known program, and for good reason. If you work full-time for a qualifying employer – that’s any U.S. federal, state, local, or tribal government organization, or a qualifying non-profit – you could have your remaining loan balance forgiven after just 120 qualifying payments. That’s 10 years of payments, but here’s the catch: you must be on a qualifying repayment plan (usually an income-driven plan) and your loans must be Direct Loans.

The PSLF Help Tool can help you determine if you’re on the right track. Many borrowers have saved hundreds of thousands of dollars through this program, but success requires staying organized and submitting your employment certification forms annually.

Teacher Loan Forgiveness offers a different path for educators. If you’re a highly qualified teacher working in a low-income school for five consecutive years, you could qualify for up to $17,500 in loan forgiveness. While the amount is smaller than PSLF, it requires fewer years of service.

Don’t forget about IDR forgiveness either. After 20 to 25 years of qualifying payments on an income-driven repayment plan, any remaining balance gets wiped clean. This might seem like a long time, but for borrowers with high debt-to-income ratios, it can be a lifeline.

The reality is that loan forgiveness requires patience and careful planning. But when you’re feeling overwhelmed by debt, it helps to remember that financial abundance can come in many forms. Some people find that exploring different approaches to wealth building, like Total Money Magnetism – New Huge Converter, opens up new perspectives on their financial journey.

What to Do If Your Loan is Past Due or in Default: Student Loan Expert Steps

Missing student loan payments happens to more people than you might think. Life gets complicated, money gets tight, and suddenly you’re facing scary letters from your loan servicer. The good news? Student loan expert advice shows there are always options to get back on track.

Understanding the difference between delinquency and default is crucial. Your loan becomes delinquent the day after you miss a payment – that’s manageable. But federal loans go into default after 270 days (about 9 months) of non-payment, and that’s when things get serious.

Default brings harsh consequences that can follow you for years. Your credit score takes a major hit, making it nearly impossible to get approved for apartments, car loans, or credit cards. The government can garnish your wages without even taking you to court, and they can seize your tax refunds too. Plus, you’ll lose access to federal student aid, deferment, and forbearance options.

But here’s what many people don’t realize: even if you’re in default, you’re not stuck forever.

Loan rehabilitation is often your best option. You’ll need to make nine consecutive, on-time payments of an amount you and your servicer agree is reasonable and affordable. Once you complete rehabilitation, the default notation gets removed from your credit report entirely – like it never happened.

Loan consolidation is another path out of default. You can consolidate your defaulted loans into a new Direct Consolidation Loan, which immediately gets you out of default status. The downside? The default stays on your credit report, though you regain access to federal benefits.

Sometimes financial stress can feel overwhelming, and it’s natural to look for ways to improve your overall situation. Many people find that exploring different approaches to financial wellness, including programs like Spiritual Salt: Brand New Spirituality Offer, High-Conversion Machine, helps them maintain a positive mindset while tackling their debt challenges.

The most important thing? Don’t ignore the problem. Your loan servicer wants to help you succeed, and there are nonprofit credit counseling agencies that can provide free guidance. The sooner you take action, the more options you’ll have available.

Strategic Student Loan Expert Advice for Debt Management and Financial Wellness

Managing student loan debt goes far beyond simply making your monthly payments. Student loan expert advice consistently emphasizes that true financial wellness comes from integrating your loans into a comprehensive financial strategy that minimizes stress while maximizing your savings potential.

The most impactful strategies typically involve consolidation and refinancing decisions, paired with smart budgeting techniques. What makes this approach so powerful? Our average client saves $167,000 on their student loans by implementing a well-thought-out strategy rather than just making minimum payments.

Think of debt management as creating your personal financial roadmap. You’re not just paying off loans – you’re building wealth, reducing anxiety, and creating opportunities for your future. This holistic approach transforms what feels like an overwhelming burden into a manageable part of your financial journey.

Many borrowers find that exploring different approaches to wealth building can complement their debt management strategy. For those interested in innovative financial mindset techniques, Total Money Magnetism – New Huge Converter offers unique perspectives on attracting abundance while managing existing obligations.

When to Consider Consolidation: Student Loan Expert Insights

The terms “consolidation” and “refinancing” often get mixed up, but understanding their differences is crucial for making the right choice for your situation. Each serves distinct purposes and comes with specific advantages and trade-offs.

Federal Loan Consolidation involves combining multiple federal student loans into a single Direct Consolidation Loan through the U.S. Department of Education. This approach simplifies your repayment by giving you one monthly bill instead of juggling multiple payments. You can also lower your monthly payment by extending the repayment period up to 30 years, and it’s particularly helpful for getting defaulted federal loans back in good standing.

However, extending your repayment period typically increases the total interest you’ll pay over the loan’s lifetime. Your new interest rate becomes a weighted average of your previous loans, rounded up to the nearest one-eighth of a percentage point. The key benefit? You retain all federal protections, including access to income-driven repayment plans and forgiveness programs.

Private Student Loan Refinancing takes a different approach entirely. You’re essentially taking out a brand-new private loan to pay off your existing student loans (federal, private, or both). This strategy can significantly lower your interest rate if you have excellent credit, potentially saving thousands of dollars. We’ve helped clients refinance over $1B+ since 2019, with many seeing substantial monthly payment reductions.

The major consideration with refinancing is that federal loans lose all federal protections when refinanced with a private lender. This means no more access to income-driven repayment plans, federal forgiveness programs like PSLF, or the flexible deferment and forbearance options that federal loans provide.

| Feature | Federal Consolidation | Private Refinancing |

|---|---|---|

| Loan Type | Federal loans only | Federal, private, or both |

| Lender | U.S. Department of Education | Private bank or lender |

| Interest Rate | Weighted average of old loans, fixed | Based on credit, potentially lower, fixed or variable |

| Benefits | Retains federal benefits (IDR, forgiveness) | Loses federal benefits |

| Credit Check | Generally not required | Required, often needs good credit/co-signer |

| Purpose | Simplify payments, access IDR/forgiveness, get out of default | Lower interest rate, reduce payment, simplify payments |

The decision often comes down to your career path, income stability, and risk tolerance. Public service workers should typically avoid refinancing federal loans, while high earners in stable private sector jobs might benefit significantly from refinancing.

Top Student Loan Expert Advice for Effective Budgeting and Earning More

Budgeting becomes your secret weapon in conquering student loan debt. It’s not about restricting yourself – it’s about gaining control, reducing anxiety, and finding extra money you didn’t know you had available for loan payments.

Tracking your income and expenses forms the foundation of effective budgeting. Start by categorizing your spending into essential expenses like rent, utilities, and groceries, versus non-essential spending like dining out and entertainment. This exercise often reveals surprising patterns in where your money actually goes each month.

Setting clear financial goals transforms budgeting from a chore into a purposeful activity. Whether you’re aiming to pay off debt faster, save for a down payment, or build an emergency fund, having specific targets motivates your budgeting efforts and helps you make better spending decisions.

The 50/30/20 rule provides an excellent starting framework: allocate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. This isn’t rigid – adjust the percentages based on your situation, but it gives you a baseline for balanced financial management.

Making extra payments can dramatically impact your loan payoff timeline. Even an additional $50 monthly can save thousands in interest and shorten your repayment by years. Always specify that extra payments should go toward the principal balance rather than future payments to maximize your impact.

Increasing your income often provides the fastest path to debt freedom. Consider freelance work, asking for a raise, or exploring side hustles that fit your schedule. For those seeking flexible earning opportunities, Live Chat Jobs – You have to try this one offers remote work possibilities that can supplement your income without interfering with your primary career.

The psychological benefits of effective budgeting often surprise people. When you know exactly where your money goes and have a plan for debt elimination, the overwhelming stress of student loans transforms into manageable, actionable steps. This mental shift can be as valuable as the actual money you save.

Some borrowers find that exploring abundance mindset techniques alongside practical budgeting improves their financial success. Resources like Cosmic Wealth Code: Breakthrough Manifestation Offer, Commission Magnet can provide additional perspectives on creating financial opportunities while managing existing debt obligations.

Student loan expert advice consistently emphasizes that small, consistent actions compound over time. The budget you create today and the extra payments you make this month will have ripple effects throughout your entire financial future.

Proactive Planning: Paying for College and Avoiding Scams with Student Loan Expert Advice

The best time to think about student loans is before you need them. Smart planning can save families thousands of dollars and prevent overwhelming debt before it starts. But with great opportunity comes great risk – scammers love to target confused families and desperate borrowers.

Let’s explore how to make smart college funding decisions and protect yourself from predators along the way.

Essential Student Loan Expert Advice for Parents and Prospective Students

College planning shouldn’t happen in a vacuum. The most successful families start these conversations early and approach them as a team effort.

Start talking money before senior year. Parents and students need to have honest conversations about who’s paying for what. Will parents cover tuition while the student handles living expenses? Is everyone expecting scholarships that might not materialize? Clear expectations prevent nasty surprises when acceptance letters arrive.

Master the financial aid process. The FAFSA (Free Application for Federal Student Aid) is your gateway to federal grants, loans, and work-study programs. Some schools also require the CSS Profile for institutional aid. File these forms as early as possible – some aid is distributed on a first-come, first-served basis.

Don’t just look at sticker prices when comparing schools. Use net price calculators on college websites to estimate your actual out-of-pocket costs after grants and scholarships. A $50,000 school might cost less than a $30,000 school once aid is factored in.

Chase free money first. Scholarships and grants don’t need to be repaid, making them infinitely better than loans. Apply for everything you qualify for – merit-based, need-based, and even quirky ones based on unusual talents or backgrounds.

Consider tax-advantaged savings early. The earlier you start saving, the more time compound interest has to work its magic. Here are the top 5 college savings vehicles to consider: 529 Plans offer the best tax advantages for education expenses, Custodial Accounts (UTMA/UGMA) provide flexibility but affect financial aid eligibility, Coverdell Education Savings Accounts work well for K-12 and college expenses, Taxable Brokerage Accounts offer maximum flexibility, and Trust Funds serve families with substantial wealth.

Protect parental retirement at all costs. We see too many parents raid their 401(k)s or IRAs to pay for college. This is usually a mistake. Your child can borrow for college, but you can’t borrow for retirement. It’s often better for students to take manageable federal loans than for parents to jeopardize their financial security.

When loans become necessary, borrow smartly. Exhaust federal options before considering private loans. Only borrow what you absolutely need, not the maximum offered. You’ll pay interest on every dollar borrowed.

Sometimes, major life decisions require looking beyond just the numbers. For families seeking deeper clarity about their path forward, exploring different perspectives on life direction can be valuable. Services like Soulmate Sketch. Over $2,000,000 Paid to Affiliates. It Just Converts offer unique insights that some find helpful when making important choices.

For those interested in building wealth alongside college planning, exploring resources like Spiritual Salt: Brand New Spirituality Offer, High-Conversion Machine might provide additional perspectives on financial abundance.

How to Spot and Avoid Student Loan Scams: Student Loan Expert Tips

Student loan scams are unfortunately common, preying on confused borrowers and desperate families. The good news? They’re usually easy to spot once you know what to look for.

Never pay upfront fees for federal loan help. This is the biggest red flag. Legitimate help with federal student aid is always free. Your loan servicer, StudentAid.gov, and nonprofit credit counselors don’t charge fees to help you apply for income-driven repayment plans, consolidate loans, or apply for forgiveness programs.

Be skeptical of instant forgiveness promises. Real forgiveness programs like PSLF require years of qualifying payments and strict eligibility requirements. No company can guarantee immediate loan discharge or forgiveness. If someone promises to eliminate your debt overnight, they’re lying.

Watch out for high-pressure tactics. Scammers love urgency. They’ll claim special programs are ending soon or that you must act immediately to qualify for help. Legitimate programs don’t work this way. Take time to research and verify any claims.

Protect your FSA ID like your social security number. Never share your Federal Student Aid ID with anyone. This gives complete access to your student aid information and allows someone to make changes to your loans without your knowledge.

Be wary of unsolicited contact. Legitimate organizations typically don’t cold-call or email offering student loan help. If someone contacts you out of the blue claiming they can help with your loans, be suspicious.

Only make payments to your official servicer. Your loan payments should go directly to your official loan servicer or the U.S. Department of Education. Never pay a third-party company to “manage” your loan payments.

Find legitimate help when you need it. Start with your loan servicer for free assistance. Use StudentAid.gov for comprehensive information about federal programs. Nonprofit credit counselors certified by organizations like the National Foundation for Credit Counseling can provide unbiased guidance. For complex situations, consider working with a Certified Student Loan Professional, but always verify their credentials first.

If you encounter a scam, report it to the Federal Trade Commission and your state’s Attorney General. Your vigilance helps protect other borrowers from falling victim to these predators.

Building financial wisdom extends beyond just avoiding scams. For those interested in developing a stronger relationship with money and wealth-building, resources like Total Money Magnetism – New Huge Converter offer alternative approaches to financial thinking that some find transformative.

When it comes to student loan expert advice, legitimate help focuses on education and empowerment, not quick fixes or upfront payments. Trust your instincts – if something feels too good to be true, it probably is.

Frequently Asked Questions about Student Loans: Student Loan Expert Answers

We hear the same questions over and over from borrowers just like you. The good news? Most concerns about student loans have clear, actionable solutions. Let’s explore the questions that keep people up at night – and more importantly, the answers that help them sleep better.

How can I lower my monthly student loan payment?

The short answer: You have more options than you might think. The key is understanding which path makes sense for your specific situation.

Income-Driven Repayment plans are your best friend if you have federal loans. These plans – including the new SAVE plan, PAYE, IBR, and ICR – calculate your payment based on what you actually earn, not what you owe. If your income is low enough relative to your debt, your payment could drop to $0 per month. Yes, you read that right – zero dollars.

For borrowers with more than $30,000 in federal loans, the Extended Repayment Plan stretches your payments over up to 25 years. Your monthly payment drops significantly, though you’ll pay more interest over time. It’s a trade-off worth considering if cash flow is tight.

Federal loan consolidation can also help by combining multiple loans into one and potentially extending your repayment term. You keep all your federal benefits while simplifying your life to just one monthly payment.

If you’re facing temporary financial hardship, deferment or forbearance can pause or reduce payments while you get back on your feet. Just remember that interest usually keeps growing during these periods.

For those with private loans or borrowers comfortable giving up federal protections, refinancing might slash your interest rate and monthly payment. At Stayplain Localseo, we help you compare lenders and rates to find the best refinancing deals available.

The bottom line? Don’t suffer in silence with payments you can’t afford. Solutions exist, and most of them are free to explore.

What happens if my student loan goes into default?

Let’s be honest – defaulting on student loans is serious business. The consequences can follow you for years and touch every corner of your financial life.

Your credit score takes a massive hit, making it nearly impossible to get approved for credit cards, mortgages, car loans, or even rental applications. We’re talking about damage that stays on your credit report for seven years.

But the government doesn’t stop there. They have collection powers that would make other creditors jealous. Your wages can be garnished without a court order. Your tax refunds – both federal and state – get seized and applied to your debt. In extreme cases, even Social Security benefits can be offset.

You also lose access to all the good stuff federal loans offer: no more deferment, forbearance, income-driven repayment plans, or eligibility for future federal student aid. It’s like being kicked out of the club just when you need it most.

Collection fees pile on top of your existing debt, and the loan holder might even take you to court. The whole situation snowballs quickly.

Here’s the critical part: if your loans are heading toward default, act immediately. Contact your servicer today – not tomorrow, not next week. Options like loan rehabilitation (making nine consecutive on-time payments) or consolidation can pull your loans back from the brink and restore your federal benefits.

Ignoring the problem never makes it disappear. But taking action, even when it feels overwhelming, almost always leads to workable solutions.

Is it worth paying for student loan help?

This question hits at the heart of a confusing marketplace filled with both legitimate help and outright scams. The golden rule is simple: you never have to pay for basic federal student loan services.

Applying for income-driven repayment plans, consolidating federal loans, or submitting paperwork for forgiveness programs like PSLF – all of this can be done completely free through your loan servicer or StudentAid.gov. Any company charging upfront fees for these services is likely running a scam.

But here’s where it gets nuanced. If you’re dealing with a complex situation – maybe you have six-figure debt, a mix of federal and private loans, or you’re considering major career changes that affect your repayment strategy – professional student loan expert advice from a certified advisor can be worth every penny.

These professionals, like Certified Student Loan Professionals (CSLPs) or financial planners specializing in student debt, offer something you can’t get from a generic government website: a personalized strategy custom to your unique circumstances. They help you see the big picture and make decisions that could save you tens of thousands of dollars over your loan’s lifetime.

The key is finding legitimate help. Look for credentials, avoid anyone demanding upfront fees for basic services, and trust your gut if something feels too good to be true.

At Stayplain Localseo, we believe in empowering you with free tools and information to make smart decisions. Our step-by-step guides, lender comparisons, and calculators help you understand your options without unnecessary costs. Our mission is helping you pay off your student loans smarter and faster – and that starts with giving you the knowledge to make informed choices.

Sometimes, managing overwhelming debt requires more than just financial strategies. For those seeking to transform their relationship with money entirely, exploring approaches like WealthGenix – First of its kind: Wealth Manifestation in Physical might offer a different perspective on abundance. Others find that developing additional income streams through opportunities like Course Creator System, – Upsell Four Products On Funnel To Promote can accelerate their debt payoff journey. And for those interested in building long-term wealth through investment education, resources like Precision Trading Academy: Master Securities Trading provide valuable financial skills.

The bottom line? Free help should always be your first stop. But don’t be afraid to invest in professional guidance when your situation calls for it – just make sure you’re working with someone legitimate who has your best interests at heart.

Conclusion: Achieve Financial Freedom with Student Loan Expert Advice

You’ve made it to the end of this comprehensive guide, and that alone shows you’re serious about taking control of your student loan debt. The journey from feeling overwhelmed by student loans to achieving financial freedom isn’t always easy, but it’s absolutely possible with the right student loan expert advice and a clear plan of action.

Think about where you started reading this guide. Maybe you felt confused by all the repayment options, worried about making the wrong choice, or stressed about how your loans were affecting your financial future. Now you have the knowledge to understand your loan types, explore income-driven repayment plans, pursue forgiveness programs, and avoid costly scams.

The most important takeaway? You don’t have to figure this out alone. Whether you’re using free resources from your loan servicer, exploring government programs, or seeking professional guidance for complex situations, help is available. The key is taking that first step.

Managing student loans is just one piece of your overall financial wellness puzzle. As you work toward paying off your debt, you might also want to explore ways to increase your income and build wealth. For those interested in alternative approaches to financial growth, resources like Total Money Magnetism – New Huge Converter offer unique perspectives on attracting abundance, while opportunities like Live Chat Jobs – You have to try this one can provide flexible ways to earn extra income.

Your action plan starts now. Log into your loan servicer account or visit StudentAid.gov to review your current situation. If you’re eligible for income-driven repayment, apply for it. If you work in public service, submit your PSLF certification. If refinancing makes sense for your situation, compare your options carefully.

Some people find that financial success comes not just from practical strategies, but from shifting their entire relationship with money. If you’re curious about exploring the deeper aspects of wealth creation, Spiritual Salt: Brand New Spirituality Offer, High-Conversion Machine offers insights into the spiritual side of financial abundance.

Financial freedom isn’t just about being debt-free – it’s about having choices, reducing stress, and building the life you want. Every extra payment you make, every smart refinancing decision, and every step you take toward understanding your loans brings you closer to that goal.

At Stayplain Localseo, we’re committed to making your student loan journey as clear and stress-free as possible. We’ve created comprehensive resources, comparison tools, and step-by-step guides because we believe everyone deserves access to expert-level advice without the expert-level price tag.

Ready to take the next step? Explore our student loan refinancing resources to find how refinancing might fit into your debt payoff strategy. Our tools and guides are designed to help you pay off your student loans smarter and faster, putting you on the path to true financial freedom.

Your future self will thank you for the actions you take today. You’ve got this.