Why Understanding Refinancing Credit Score Requirements Matters

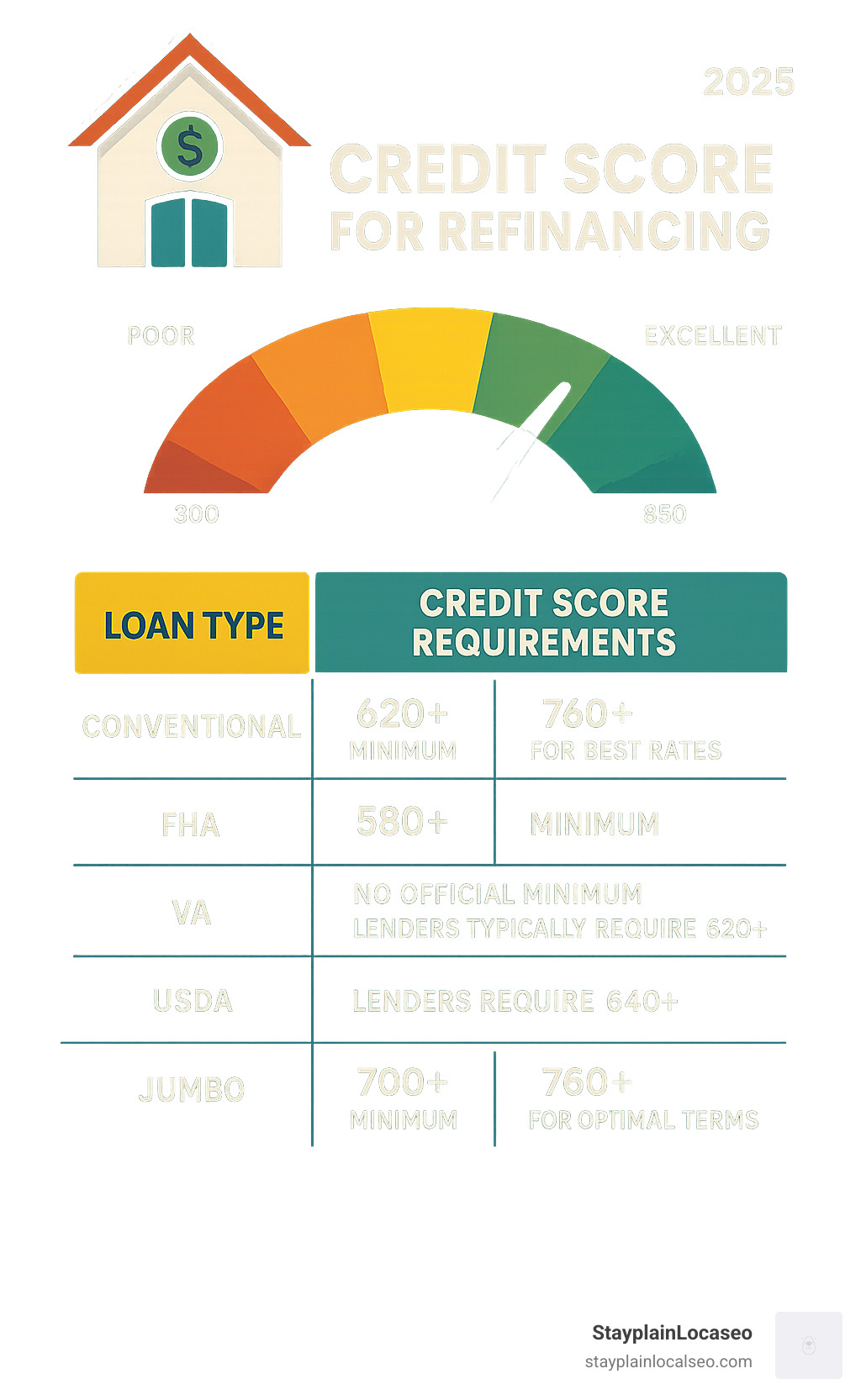

Credit score for refinancing is the key factor that determines whether you’ll qualify for better loan terms and save thousands of dollars. Most lenders require a minimum credit score of 620 for conventional refinancing, but the requirements vary significantly by loan type.

Quick Answer: Credit Score Requirements by Loan Type

| Loan Type | Minimum Credit Score | Best Rates Score |

|---|---|---|

| Conventional | 620 | 760+ |

| FHA | 580 | 620+ |

| VA | No minimum (lenders typically require 620) | 620+ |

| USDA | No minimum (lenders typically require 640) | 640+ |

| Jumbo | 700+ | 760+ |

The difference between having a good versus excellent credit score can save you over $54,000 in interest over 30 years on a $330,000 mortgage. A borrower with a 760+ FICO score might qualify for a 7.11% interest rate, while someone with a 620-639 score could face a 7.78% rate.

Understanding your credit score requirements isn’t just about qualification – it’s about taking control of your financial future. Whether you’re looking to lower monthly payments, reduce interest rates, or tap into home equity, knowing where you stand credit-wise is the first step toward achieving your refinancing goals.

Ready to attract more abundance? Try this 7-second Tesla ritual to attract money.

The good news? Even if your credit score isn’t perfect, there are still refinancing options available. Government-backed programs like FHA streamline refinancing may work with scores as low as 500-580, and improving your credit score is entirely within our control.

Credit score for refinancing terms at a glance:

Step 1: Understanding Credit Score Requirements for Refinancing

When it comes to refinancing, your credit score for refinancing acts like your financial passport. It’s the first thing lenders peek at to decide whether you’re worth the risk – and more importantly, what kind of deal they’re willing to offer you.

Think of it this way: lenders are essentially asking, “How likely is this person to pay me back?” Your credit score gives them a pretty good answer based on your past financial behavior. The higher your score, the more doors open to better interest rates and loan terms.

What Credit Score Do You Need to Refinance a Loan?

Here’s where things get interesting – there’s no magic number that works for every situation. The credit score for refinancing requirements shift depending on what type of loan you’re after, kind of like how different clubs have different dress codes.

Conventional loans are the bread and butter of refinancing. Most lenders want to see at least a 620 credit score, but honestly, that’s just getting your foot in the door. If you really want lenders to roll out the red carpet with their best rates, you’ll want to aim for 760 or higher. The difference is pretty dramatic – we’re talking about potentially saving over $54,000 in interest over 30 years on a typical mortgage.

Jumbo loans play in a different league entirely. Since these loans exceed the limits that Fannie Mae and Freddie Mac will buy, lenders get nervous and typically require a minimum score of 700. Some lenders push this even higher to 720 for their most competitive rates.

Now, here’s where things get more hopeful for folks with lower scores. Government-backed loans often come with more flexible requirements because Uncle Sam is backing the deal.

FHA refinancing can work with scores as low as 580, though individual lenders might set their bar a bit higher. For cash-out refinances, the FHA technically allows scores as low as 500, but finding a lender willing to go that low is like finding a parking spot at the mall during the holidays – possible, but rare.

VA refinancing is fantastic for our veterans. The VA itself doesn’t set a minimum credit score, which is pretty amazing. However, most lenders still want to see around 620 or higher. It’s one of those “the government says yes, but your lender might say maybe” situations.

USDA refinancing follows a similar pattern. While the USDA doesn’t mandate a specific score, most lenders look for 640 or better for rural property refinancing.

Here’s the golden rule: if you can get your credit score to 760 or above, you’re in the sweet spot for the absolute best rates. This is where the real savings magic happens. The difference between a 7.11% rate (for excellent credit) and a 7.78% rate (for fair credit) might seem small, but over 30 years, it adds up to serious money.

Your credit score essentially tells lenders your story – are you someone who pays bills on time, keeps debt manageable, and handles financial responsibility well? The better your story, the better your refinancing options become. For the most current conventional loan requirements, you can always check the Fannie Mae Selling Guide for detailed guidelines.

The bottom line? While minimum scores get you in the game, higher scores get you the best seats in the house.

Step 2: Evaluating Factors Beyond Your Credit Score for Refinancing Approval

While our credit score for refinancing is undeniably the star of the show, it’s not performing a solo act. Lenders take a much broader view of our financial picture, almost like they’re putting together a puzzle where our credit score is just one important piece. This holistic approach helps them understand whether we’re truly ready to handle a new mortgage.

What Else Do Lenders Look For When Refinancing?

Think of the refinancing approval process as a financial health checkup. Just like a doctor doesn’t diagnose based on one symptom alone, lenders don’t make decisions based solely on our credit score. They want to see the full story of our financial well-being.

Our Debt-to-Income (DTI) Ratio is like a financial balancing act that lenders watch closely. This number compares all our monthly debt payments to our gross monthly income, giving lenders a clear picture of how much breathing room we have in our budget. When our DTI is lower, it signals that we have more wiggle room to handle our mortgage payments comfortably. Most lenders love to see a DTI of 36% or less, though they might stretch to 43% or even higher for borrowers with stellar credit scores. The stronger our credit score for refinancing, the more forgiving lenders tend to be with a higher DTI.

The Loan-to-Value (LTV) Ratio tells the story of how much equity we’ve built in our home. If our house is worth $300,000 and we still owe $225,000, we have $75,000 in equity, making our LTV 75%. Lenders generally feel most comfortable when we have at least 20% equity (an LTV of 80% or less). More equity is like having a bigger safety net – it shows we have skin in the game and reduces the lender’s risk. Plus, having that 20% equity often means we can skip private mortgage insurance, which keeps more money in our pockets each month.

Looking for new ways to earn? Check out Live Chat Jobs you can start today.

Stable Income & Employment History is where lenders look for consistency and predictability. They want to see that we’ve been steadily employed, ideally in the same field, for at least two years. It’s not just about how much we make – it’s about showing that our income is reliable and likely to continue. Lenders will ask for pay stubs, W-2s, and sometimes tax returns to verify that our financial foundation is solid.

Some lenders also want to see Cash Reserves – essentially our financial emergency fund. They might require proof that we have enough savings to cover 2-6 months of mortgage payments after the refinance closes. This requirement is especially common when other factors, like our credit score or DTI, are less than perfect. It’s their way of ensuring we have a backup plan if life throws us a curveball.

When our credit score for refinancing isn’t in the excellent range, the Impact of Lower Credit Scores extends far beyond just higher interest rates. Lenders become more cautious and might tighten their requirements in other areas. We might need a lower DTI ratio, more home equity, or larger cash reserves to compensate for the perceived higher risk. Additionally, if our LTV creeps above 80%, we might find ourselves paying for private mortgage insurance even if we weren’t required to before – which is another compelling reason to work on improving our credit score before applying.

The beauty of understanding these factors is that it gives us a roadmap for improvement. While we can’t change our employment history overnight, we can work on paying down debt to improve our DTI, or focus on building our credit score to open up more favorable terms. Lenders want to say yes – they just need to feel confident that we can successfully manage the new loan.

Step 3: Improving Your Credit Score and Navigating the Refinancing Process

The beautiful thing about credit scores is that they’re not set in stone. Even if our credit score for refinancing isn’t where we’d like it to be today, we have the power to change that story. With some patience and strategic moves, we can significantly boost our creditworthiness and open up better refinancing opportunities.

How to Boost Your Credit Score for Refinancing Success

Think of improving our credit score like training for a marathon – it requires consistency, but the results are absolutely worth it. The strategies that make the biggest difference are often simpler than we might expect.

Making on-time payments is hands down the most powerful move we can make. This single factor accounts for 35% of our FICO score, so even one late payment can sting. Setting up automatic payments for all our bills creates a safety net that ensures we never accidentally miss a due date. It’s like having a financial guardian angel watching over us.

Lowering our credit utilization often delivers the quickest boost to our score. This means using less of our available credit across all our cards and lines of credit. If we have a credit card with a $10,000 limit, keeping our balance below $3,000 (30% utilization) is good, but staying under $1,000 (10% utilization) is even better. Sometimes we can see our score jump within just a few weeks of paying down balances.

Disputing errors on our credit report is like finding free money. Mistakes happen more often than we’d think, and these errors can unfairly drag down our score. We should check our credit reports from all three bureaus regularly and challenge anything that doesn’t look right. Getting our free credit reports at AnnualCreditReport.com is the perfect place to start this detective work.

Avoiding new credit accounts before applying for refinancing is crucial timing. Every new credit application creates a small ding on our credit, and opening new accounts also makes our credit history look younger on average. It’s like trying to impress someone while simultaneously showing them we’re still figuring things out – not the best combination.

Considering paying down existing debt creates a double win. Not only does it improve our credit utilization ratio, but it also frees up more of our monthly income, which helps our debt-to-income ratio too. It’s one of those rare financial moves that helps us in multiple ways at once.

Want to manifest more wealth? Find WealthGenix, a unique wealth manifestation system.

Refinancing Options for Borrowers with Lower Credit Scores

Having a less-than-perfect credit score doesn’t mean we’re out of luck. Government-backed refinancing programs understand that life happens, and they’ve created pathways specifically for borrowers who might not qualify for conventional refinancing.

The FHA Streamline Refinance is like a gift for current FHA loan holders. If we already have an FHA loan and have been making our payments on time for the past 12 months, this program often doesn’t even require a minimum credit score check. It’s designed to be simple – no new appraisal needed, minimal paperwork, and the whole process focuses on getting us a lower rate rather than re-evaluating our entire financial picture.

For our veterans, the VA Interest Rate Reduction Refinance Loan (IRRRL) works similarly. It’s the VA’s way of saying “thank you for your service” by making it easier to lower monthly payments. Like the FHA option, it typically skips the extensive credit review and appraisal process, focusing instead on whether the refinance actually benefits us.

The USDA Streamlined Assist program serves rural property owners who currently have USDA loans. It offers a path to refinancing even when we don’t have much equity built up, as long as we’ve been responsible with our current payments.

While these programs are more flexible with credit score for refinancing requirements, individual lenders can still add their own rules on top of the government guidelines. However, these options exist specifically to help borrowers who might not qualify elsewhere, so they’re definitely worth exploring.

How Does Applying for Refinancing Affect Your Credit Score?

Many of us worry about the credit score impact of applying for refinancing, but the reality is much less scary than the rumors suggest. Yes, there are some temporary effects, but they’re manageable and usually worth it for the long-term benefits.

When lenders check our credit during the application process, they perform what’s called a hard inquiry. This typically causes our score to dip by about 5 to 10 points temporarily. It sounds alarming, but it’s like a small scratch that heals quickly with good financial habits.

Here’s where it gets interesting: credit scoring models are smart enough to know we’ll shop around for the best rates. If we apply with multiple lenders within a 14 to 45-day window, all those inquiries get bundled together and treated as just one inquiry. This “rate-shopping window” is designed to protect smart consumers who comparison shop, so we can get multiple quotes without multiple credit hits.

Curious about more ways to improve your life? Find the power of Moringa, the most powerful plant on the planet.

When we refinance, we’re technically closing our old mortgage and opening a new one. If our old mortgage was our oldest credit account, this might slightly reduce the average age of our credit accounts. However, this effect is usually minimal and temporary, especially compared to the positive impact of consistent on-time payments on our new, hopefully lower-rate loan.

The key to minimizing any negative impact is continuing to make all our payments on time, especially on our new refinanced loan. Most borrowers find that any temporary dip in their credit score for refinancing quickly recovers, and often their score ends up higher than before thanks to better loan terms that make payments more manageable.

We’re playing the long game here. A few points of temporary credit score fluctuation is a small price to pay for potentially saving thousands of dollars in interest over the life of our loan.

Frequently Asked Questions About Credit Scores and Refinancing

When we’re thinking about refinancing, it’s completely normal to have questions swirling around in our heads. The process can feel overwhelming, especially when it comes to understanding how our credit score for refinancing fits into the bigger picture. Let’s tackle some of the most common concerns we hear from borrowers just like you.

What’s the Difference Between Refinancing and Renewing a Mortgage?

This question comes up all the time, and honestly, it’s easy to see why people get confused! The terms sound similar, but they’re actually quite different processes with very different implications for our credit.

When we refinance, we’re essentially starting fresh with a brand new loan. Think of it like trading in our old car for a new one – we’re getting rid of the old mortgage completely and replacing it with something entirely different. This new loan can have different terms, a new interest rate, and we might even work with a completely different lender. Because it’s a new loan application, lenders need to check our creditworthiness all over again, which means a hard inquiry on our credit report. Our credit score for refinancing becomes a major factor in whether we get approved and what kind of rates we’ll qualify for.

Renewing a mortgage, on the other hand, is more like extending a subscription. When our mortgage term ends (which happens every few years in some markets), we’re simply continuing our existing loan agreement with our current lender for another term. The loan amount stays the same, and while the interest rate might change based on current market conditions, we’re not applying for a brand new loan. The beautiful thing about renewal is that it typically doesn’t require a credit check at all, since we’re just extending an existing relationship with our lender.

How Long Does a Hard Inquiry from a Refinance Stay on My Credit Report?

Here’s something that might surprise you – while a hard inquiry from our refinance application will stick around on our credit report for two full years, it doesn’t actually hurt our score for that entire time. The impact on our credit score for refinancing typically lasts for about one year, and even then, we’re usually talking about a pretty small dip.

Rate-shopping window we talked about earlier? This is where it really pays off to be strategic. If we submit all our refinance applications within that 14 to 45-day window, the credit scoring models are smart enough to recognize that we’re just shopping around for the best deal. Instead of counting each inquiry separately, they bundle them all together as one single inquiry. It’s like the credit bureaus are saying, “Hey, we get it – you’re being a smart consumer and comparing your options!”

Curious about more ways to improve your life? Find the power of Moringa, the most powerful plant on the planet.

Are the Benefits of Refinancing Worth the Temporary Credit Score Drop?

This is probably the question that keeps most people up at night, and we totally understand why. Nobody wants to see their credit score go down, even temporarily. But here’s the thing – for most people, the answer is a resounding yes, the benefits absolutely outweigh that small, temporary dip.

Let’s put this into perspective. That temporary drop in our credit score for refinancing is usually just 5 to 10 points, and it doesn’t last long. Compare that to the potential savings we could see from refinancing, and it’s really no contest.

Imagine we’re able to shave even half a percentage point off our interest rate. Over the life of a 30-year mortgage, that could mean saving tens of thousands of dollars. Or maybe refinancing allows us to lower our monthly payment by $200 or $300, giving us breathing room in our budget every single month. That extra cash flow can reduce financial stress and actually make it easier to pay all our bills on time, which helps our credit score improve over the long run.

Some people use refinancing to tap into their home equity for major expenses like home improvements or consolidating high-interest credit card debt. If we can pay off credit cards charging 18% or 20% interest by using our home equity at a much lower rate, we’re not just saving money – we’re also likely to see our credit score improve as our credit utilization drops.

The key is looking at the big picture. Yes, there might be a small, temporary blip in our credit score, but if refinancing puts us in a stronger financial position overall, that short-term sacrifice is usually well worth it. Plus, as we continue making on-time payments on our new, better loan terms, our credit score will recover and often end up better than where we started.

Looking to boost your financial knowledge? Check out these wealth-building strategies.

Conclusion

Taking control of your credit score for refinancing journey doesn’t have to feel overwhelming. We’ve walked through this together, breaking it down into three clear, actionable steps that can transform your financial future.

First, we explored understanding credit score requirements – from the basic 620 minimum for conventional loans to that golden 760+ score that open ups the best rates and biggest savings. Whether you’re considering an FHA loan with its more flexible 580 minimum or aiming for a jumbo loan requiring 700+, knowing where you stand gives you the power to plan ahead.

Next, we dove into evaluating factors beyond your credit score. Your DTI ratio, LTV ratio, stable income, and cash reserves all work together with your credit score to paint the complete picture lenders want to see. It’s reassuring to know that even if one area isn’t perfect, strength in others can help balance things out.

Finally, we covered improving your credit score and navigating the process – those practical steps like making on-time payments, lowering credit utilization, and understanding how hard inquiries work. These aren’t just theoretical concepts; they’re real tools you can use starting today to boost your refinancing prospects.

At StayplainLocalseo, we’re passionate about making complex financial topics feel approachable and actionable. While we specialize in helping students and graduates steer loan refinancing, these credit score principles apply whether you’re dealing with student loans, mortgages, or any other type of refinancing.

That temporary 5-10 point dip from a hard inquiry is nothing compared to the thousands you could save with better loan terms. The key is taking that first step – checking where your credit stands, understanding your options, and moving forward with confidence.

Your financial goals are within reach. By applying what we’ve covered today and staying consistent with good credit habits, you’re setting yourself up for refinancing success and long-term financial health.

Curious about more ways to improve your life? Find the power of Moringa, the most powerful plant on the planet.

Explore our expert guides on Student Loan Refinancing