Why Understanding Student Loan Refinancing Can Transform Your Financial Future

Learning how to refinance student loans step by step can save you thousands of dollars and simplify your monthly payments. This guide breaks down the process into 6 essential steps.

Quick Answer: The 6-Step Student Loan Refinancing Process

- Assess your eligibility – Check your credit score (typically 650+), income stability, and debt-to-income ratio.

- Research and compare lenders – Get pre-qualified with multiple lenders using soft credit checks.

- Choose your loan terms – Select between fixed or variable rates and pick your repayment period.

- Submit your application – Complete the formal application with required documentation.

- Review and sign – Carefully read loan terms and sign your agreement (with a 3-day rescission period).

- Wait for payoff – Continue paying old loans until your new lender confirms they’ve been paid off.

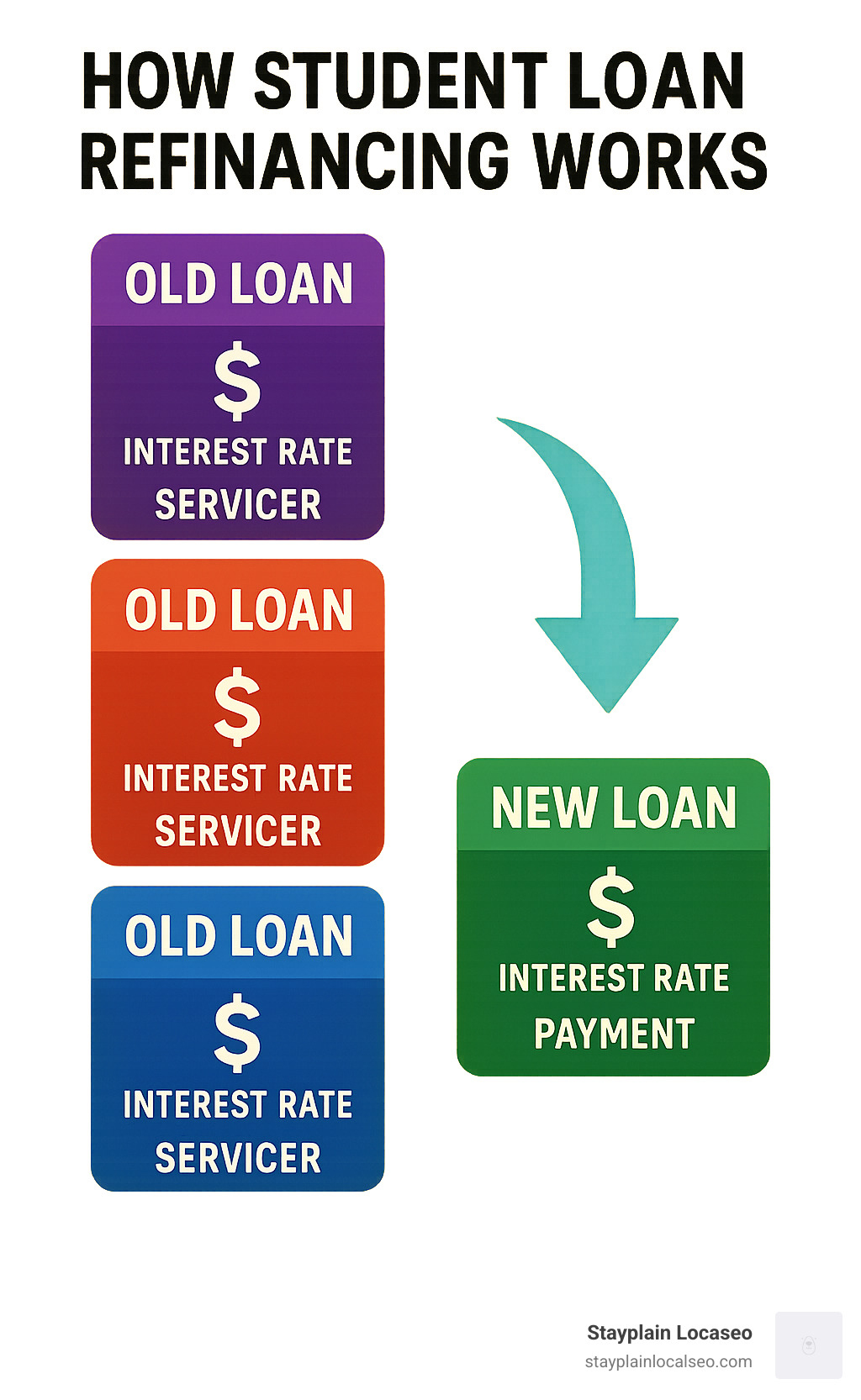

Refinancing can be a powerful tool for financial freedom. It replaces your existing loans with a single new loan, often at a lower interest rate, which can lower your monthly payment and reduce the total interest you pay.

However, refinancing isn’t right for everyone. You’ll lose federal loan benefits like income-driven repayment plans and forgiveness programs if you refinance federal loans with a private lender. Understanding each step is crucial before making this permanent decision.

The process is straightforward and can be completed in just a few weeks, with many borrowers seeing immediate benefits.

What is Student Loan Refinancing and Is It Right for You?

Student loan refinancing means taking out a new private loan to pay off your existing student loans—whether they’re federal, private, or a mix of both. The goal is to get better terms, such as a lower interest rate.

It’s important to understand the difference between refinancing and consolidation. Federal loan consolidation combines multiple federal loans into one new federal loan, keeping your federal benefits. The interest rate is a weighted average of your old rates, so it simplifies payments but doesn’t typically save you money.

Refinancing, done through private lenders, replaces your old loans with a new private loan. This can save you money but comes with significant trade-offs.

The main benefits of refinancing include:

- Lower interest rates: If your credit has improved or market rates have dropped, you could save thousands over your loan’s lifetime.

- Simplified payments: Instead of juggling multiple servicers, you’ll have one monthly payment to one lender.

- Lower monthly payments: Extending your repayment term can lower your monthly bill, though it may increase the total interest paid.

Here’s the critical trade-off: If you refinance federal loans with a private lender, you permanently lose all federal benefits. Once you refinance federal loans, there’s no going back.

Lost federal benefits include Income-Driven Repayment (IDR) plans, Public Service Loan Forgiveness (PSLF), and flexible deferment and forbearance options. For detailed information, review the official federal loan benefits before deciding.

Who Should Consider Refinancing?

Refinancing is ideal for borrowers with:

- Strong credit history: A score in the upper 600s is often the minimum, with the best rates going to those with scores above 750.

- Stable income: Lenders want to see consistent employment and a debt-to-income ratio below 50%.

- High-interest private loans: Refinancing these loans is often a smart move since you aren’t giving up federal protections.

- No need for federal protections: If you have strong job security and don’t need income-based payments or forgiveness programs, refinancing federal loans can make financial sense.

When Might It Be Better to Wait?

It may be better to wait if you have:

- Bad credit or unstable employment: You’ll likely be disqualified or offered poor rates. Focus on building your credit and employment history first.

- Reliance on federal forgiveness programs: Refinancing federal loans would make you ineligible for programs like PSLF.

- Limited credit history: Recent graduates often benefit from waiting a year or two to build a stronger credit profile, which can lead to better refinancing offers.

Preparing to Refinance: Getting Your Finances in Order

Before you apply to refinance, you need to get your finances in order. Lenders carefully evaluate your financial health to determine your eligibility and interest rate. A little preparation can help you secure the best possible terms.

Your credit score is the most important factor. Most lenders require a score in the mid-600s to consider an application, but the best rates are typically reserved for borrowers with scores of 750 or higher. You can improve your score by paying all bills on time, reducing credit card balances, and avoiding new credit applications before you refinance.

Lenders also review your debt-to-income (DTI) ratio, which is your total monthly debt payments divided by your gross monthly income. Most lenders prefer a DTI of 50% or lower. A steady job and reliable income are also essential, and some lenders have minimum income requirements.

For more details, we’ve put together a comprehensive guide on minimum credit score requirements for refinancing.

The Role of a Cosigner

If your credit or income isn’t strong enough to qualify on your own, a cosigner can help. A cosigner is a trusted person with strong credit and stable income who agrees to share responsibility for the loan. This can help you get approved and may even secure you a lower interest rate.

Since a cosigner is equally responsible for the debt, look for lenders that offer a cosigner release option. This allows you to remove the cosigner from the loan after making a certain number of on-time payments (typically 12 to 48), proving you can handle the responsibility alone.

Required Documentation

Gathering your documents ahead of time will streamline the application process. You will generally need:

- Government-issued ID: Driver’s license or passport.

- Social Security number: For identity verification and credit checks.

- Proof of income: Recent pay stubs, W-2s, or tax returns if self-employed.

- Loan payoff statements: From your current lenders, showing balances, rates, and account numbers for every loan you’re refinancing. You may need a “10-day payoff amount.”

- Proof of graduation: A diploma or transcript may be required.

How to Refinance Student Loans Step by Step: A Complete Walkthrough

With your finances prepped and documents gathered, you’re ready to start the refinancing process. Here’s your step-by-step guide to navigating how to refinance student loans step by step.

Step 1: Research and Compare Lenders

Don’t commit to the first lender you find. Comparing offers can save you thousands. Get prequalified with at least three to five different lenders, including banks, credit unions, and online lenders. Prequalification uses a soft credit check, which won’t affect your credit score.

When comparing, look beyond the interest rate. Examine the loan terms each lender offers, such as repayment periods (e.g., 5 to 20 years). Also, check the lender’s reputation through customer reviews, and look for good customer service and hardship options like forbearance. Choose lenders that don’t charge application fees, origination fees, or prepayment penalties.

Step 2: Choose the Best Offer and Loan Terms

After gathering your offers, select the best one for your situation. The biggest decision is choosing between fixed vs. variable rates. A fixed rate remains the same for the life of the loan, offering predictable payments. A variable rate can fluctuate with the market, often starting lower but carrying more risk. For most borrowers, the stability of a fixed rate is preferable.

Your repayment period also affects your monthly payment amount and total loan cost. A shorter term means higher monthly payments but less interest paid over time. A longer term lowers your monthly payment but costs more in total interest. Also, look for autopay discounts (typically 0.25%) to lower your rate further.

Step 3: Complete the Application and Submit Documents

Submitting a formal application involves a hard credit check, which may cause a small, temporary dip in your credit score. This is a normal part of the process.

Most applications are completed online. You’ll upload your required documents to the lender’s secure portal. Be thorough to avoid delays. The lender will verify your employment and income, often providing a decision within a few days. At this stage, you’ll finalize your loan details, including your exact interest rate and repayment schedule.

Step 4: Sign the Agreement and Wait for Loan Payoff

You’re almost done. Your lender will send a final loan disclosure detailing your new loan’s terms. Review it carefully. After signing, you have a federally mandated three-day rescission period to cancel the loan without penalty.

Once the rescission period passes, your new lender pays off your old loans, which can take one to two weeks. This is critical: continue making payments on your original loans until you receive written confirmation that they have a zero balance. Missing a payment during this transition can damage your credit score.

Making the Right Choices: Understanding Your New Loan Terms

After refinancing, you must choose your new loan terms. These choices will impact your finances for years. The biggest decision is between a fixed and variable interest rate.

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Stability | Stays the same throughout the loan’s life | Can fluctuate with market conditions |

| Predictability | Monthly payments are consistent and predictable | Monthly payments can go up or down |

| Initial Rate | Often starts slightly higher than variable rates | May start lower than fixed rates |

| Risk | Low risk; no surprises | Higher risk; payments could increase significantly |

| Best For | Borrowers seeking stability and long-term predictability | Borrowers who plan to pay off their loan quickly or are comfortable with market risk |

Fixed rates are locked in for the life of the loan, providing a predictable monthly payment that makes budgeting easier. Variable rates are tied to market benchmarks and can change. They often start lower but carry the risk of rising over time, potentially costing you more.

Your repayment period is a trade-off between monthly affordability and long-term savings.

- Shorter terms (e.g., 5-7 years) have higher monthly payments but save you thousands in total interest.

- Longer terms (e.g., 15-20 years) offer lower monthly payments but cost significantly more in total interest over the loan’s life.

Most lenders offer an autopay discount of around 0.25% for setting up automatic payments. This is an easy way to save money.

Common Pitfalls to Avoid When Refinancing

- Focusing only on the monthly payment: A lower payment from a longer term can cost you more in total interest. Look at the big picture.

- Not reading the fine print: Understand all fees, penalties, and hardship options before signing.

- Stopping old loan payments too soon: Continue paying your old loans until you get written confirmation they are paid off to avoid a late payment on your credit report.

- Underestimating variable rate risk: Be sure you’re comfortable with the possibility that your payment could increase.

What Happens After Your Refinance is Complete?

Once finalized, you’ll receive confirmation letters from your old servicers showing zero balances and welcome materials from your new lender. Set up your new payment system, preferably with autopay to get the discount and avoid missed payments. You’ll now have one streamlined payment to manage. Your first payment is typically due 30-45 days after the payoff is complete.

Frequently Asked Questions about Student Loan Refinancing

Here are answers to the most common questions about how to refinance student loans step by step.

How many times can you refinance a student loan?

There’s no limit to how many times you can refinance your student loans. You can refinance whenever it makes financial sense.

You might refinance again if your credit score improves, market interest rates drop, or you want to achieve a new goal, like removing a cosigner or switching from a variable to a fixed rate. The key is to ensure each refinance provides a tangible benefit, such as a lower interest rate or better loan terms.

Does refinancing hurt your credit score?

Refinancing can cause a small, temporary dip in your credit score, but it can help your credit in the long run.

- Prequalification uses a “soft credit check,” which does not affect your score. You can check rates from multiple lenders without impact.

- Formal application requires a “hard credit check,” which can lower your score by a few points temporarily. Credit scoring models often group multiple inquiries within a short period (14-45 days) as a single event to minimize the impact.

- Long-term, making consistent, on-time payments on your new loan can build a positive payment history and improve your credit score over time.

What’s the difference between refinancing and consolidation?

These terms are often confused, but they are very different.

-

Student loan refinancing involves taking out a new private loan to pay off existing loans. The primary goal is to get a lower interest rate and/or new repayment terms. When you refinance federal loans, you lose access to federal benefits like income-driven repayment and forgiveness programs.

-

Federal loan consolidation is a federal program that combines multiple federal loans into a single new federal loan. Your new interest rate is a weighted average of the old rates, so you likely won’t save money on interest. However, you simplify your payments and keep all your federal benefits.

Think of it this way: refinancing is for better loan terms, while consolidation is for simplifying federal loans while retaining their protections. For more details on federal options, visit the official federal student aid website.

Conclusion: Taking the Next Step in Your Financial Journey

You’ve learned how to refinance student loans step by step and now have the tools to make an informed decision about your financial future. The benefits are significant: lower interest rates can save you thousands, and simplified payments reduce stress and complexity.

However, refinancing isn’t for everyone. The decision to give up federal loan protections is permanent and should not be taken lightly. If you are working toward loan forgiveness or rely on income-driven repayment plans, refinancing your federal loans may not be the right choice.

If you have good credit, stable income, and high-interest loans (especially private ones), refinancing could be a financial game-changer. The key is to match your choice to your unique situation and goals.

At Stayplain Localseo, we’re here to support you. We created our platform to make student loan management clear and accessible. We are committed to empowering your financial future with the resources and knowledge you need.

Your student loans don’t have to define your financial story. With the right strategy, you can take charge of your debt and create more breathing room in your budget.

Ready to explore your options? Take control of your student loans today and see how refinancing might fit into your financial journey. You’ve got this!