Your First Step to Lower Student Loan Payments

The minimum credit score to refinance student loans is typically 670, though some lenders may accept scores as low as 650 or even in the fair range of 580-669 with additional requirements.

Quick Answer: Credit Score Requirements for Student Loan Refinancing

- Generally Required: 670+ credit score

- Good Credit Range: 670-739 (better rates)

- Fair Credit Options: 580-669 (limited lenders, higher rates)

- Excellent Credit: 740+ (best rates and terms)

- With Co-signer: May qualify with lower scores

If you’re drowning in student loan payments, checking your credit score is the smartest first move you can make. Your credit score directly determines whether you qualify for refinancing and what interest rate you’ll receive.

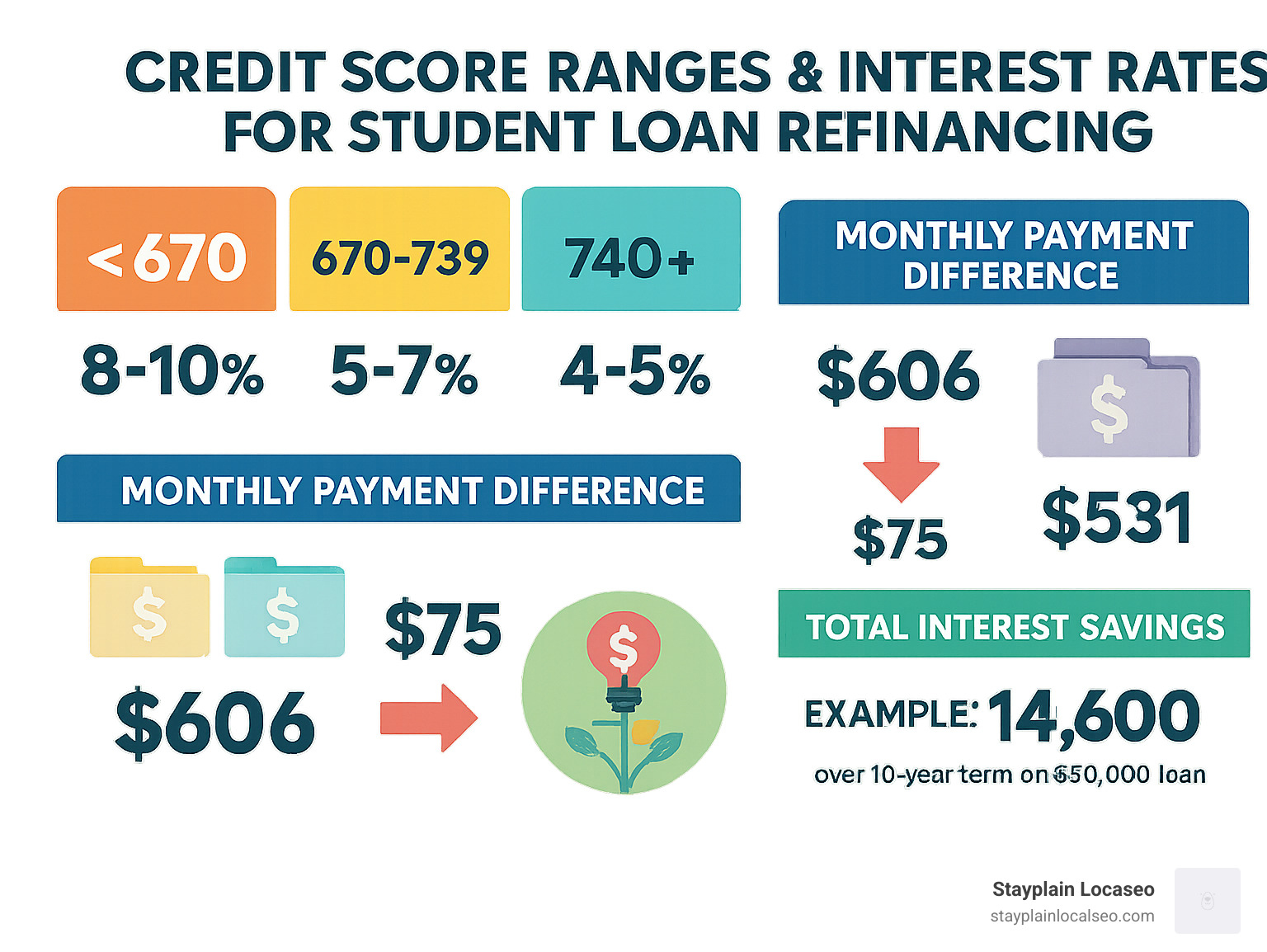

Here’s why this matters: A borrower with a 760+ credit score might qualify for rates around 4-5%, while someone with a 650 score could face rates of 8-10% or higher. On a $50,000 loan, that difference could mean paying thousands more in interest over the life of your loan.

The good news? Even if your score isn’t perfect, you still have options. Some lenders work with borrowers in the “fair” credit range, and strategies like adding a co-signer can open doors to better rates.

Refinancing can help you:

- Lower your monthly payments

- Reduce total interest paid

- Simplify multiple loans into one payment

- Remove a co-signer from your original loans

What is the Minimum Credit Score to Refinance Student Loans?

Here’s the straight answer: most lenders require a minimum credit score of 670 to refinance student loans. This magic number marks the beginning of what’s considered “good” credit territory, which runs from 670 to 739 on the FICO scale.

But here’s where it gets interesting – not every lender plays by the exact same rules. While 670 is the sweet spot that opens the most doors, some lenders are willing to work with borrowers who have scores in the mid-600s. A few might even consider applications from people with “fair” credit scores, which fall between 580 and 669.

Think of it like dating – everyone has their preferences, but there’s someone out there for almost everyone. The key is knowing where to look and what to expect.

If you’re wondering exactly where you stand, understanding your FICO Score is crucial since it’s what most lenders use to evaluate your creditworthiness. You can learn more about how it works at What is a FICO Score?

The bottom line? While 670 is generally the minimum credit score to refinance student loans, don’t give up hope if you’re sitting a bit lower. You might just need to dig a little deeper to find the right lender.

How a Higher Credit Score Opens up Better Interest Rates

Your credit score is basically your financial reputation score – and lenders take it very seriously. The higher your score, the more they trust you, and the more they trust you, the better deal they’re willing to offer.

It’s simple math from their perspective: higher credit scores mean lower risk, and lower risk means better interest rates. When you’ve proven you’re reliable with credit, lenders compete for your business instead of the other way around.

Here’s where the significant long-term savings really add up. Let’s say you’re refinancing $50,000 in student loans over 10 years:

| Credit Score Range | Representative APR | Estimated Monthly Payment | Estimated Total Interest Paid |

|---|---|---|---|

| 740+ (Excellent) | 4.50% | $518 | $12,160 |

| 670-739 (Good) | 6.00% | $555 | $16,580 |

| 580-669 (Fair) | 8.00% | $607 | $22,880 |

These numbers are examples for a $50,000 loan over 10 years and can vary based on lender and market conditions.

Look at that difference! Moving from fair credit to excellent credit could save you over $10,000 in interest payments. That’s not pocket change – that’s a nice car, a solid emergency fund, or a great start on a house down payment.

Even bumping your score from good to excellent saves you about $4,400. That’s why it’s worth taking some time to improve your credit before applying if you can.

Can You Refinance with a “Fair” Credit Score?

Yes, you absolutely can refinance with a fair credit score – but let’s be realistic about what that looks like. Some lenders do accept scores in the mid-600s, but your options will be more limited, kind of like shopping for clothes at a small boutique instead of a big department store.

The trade-off is pretty straightforward: fewer lenders means higher interest rates. Lenders who work with fair credit borrowers know they’re taking on more risk, so they charge accordingly. You’ll still save money compared to keeping high-interest loans, but the savings won’t be as dramatic.

Here’s where a co-signer can be a game-changer. If you have a family member or friend with strong credit who’s willing to co-sign, you might qualify for much better rates. We’ll talk more about co-signers later, but it’s definitely worth considering.

The most important thing if you have fair credit? Shop around like your financial future depends on it – because it kind of does. Different lenders have different risk appetites, and what one lender considers too risky, another might be happy to approve. Don’t settle for the first offer you get.

Beyond the Score: Other Factors Lenders Review

Your credit score might be the star of the show, but it’s definitely not performing solo. When lenders evaluate your application for student loan refinancing, they’re looking at the whole picture of your financial life. Think of it like getting to know someone new – you wouldn’t judge them based on just one conversation, right?

Lenders want to feel confident that you can handle your new loan payments without breaking a sweat. That’s why they dig deeper into your finances, examining everything from your monthly income to your debt load. The good news is that even if your minimum credit score to refinance student loans isn’t quite where you’d like it to be, these other factors can work in your favor.

Why Your Debt-to-Income (DTI) Ratio Matters

Your Debt-to-Income ratio is basically a snapshot of how much of your monthly paycheck goes toward paying off debts. It’s one of those numbers that can make or break your refinancing application, even if your credit score looks great on paper.

Here’s how it works: take all your monthly debt payments (student loans, credit cards, car payments, mortgage) and divide that by your gross monthly income. The result is your DTI ratio, expressed as a percentage.

Most lenders want to see your DTI below 50%, but here’s the inside scoop – if you can get it under 40%, you’ll be in much better shape. A lower DTI tells lenders that you’re not stretched too thin financially and can comfortably handle another loan payment.

But DTI isn’t just about the math. Lenders also want to see that your income is stable and reliable. Whether you’re working a traditional 9-to-5 job, freelancing, or running your own business, they need proof that money keeps flowing in consistently. This usually means showing recent pay stubs, tax returns, or bank statements.

If you’re unsure about your DTI or want to double-check your calculations, this helpful guide can walk you through it: How to calculate your DTI ratio.

Additional Eligibility Requirements

Beyond your credit score and DTI, lenders have a few more boxes they need you to check. Don’t worry – these requirements are pretty straightforward, and most graduates meet them without any issues.

Proof of graduation is usually a must-have. Lenders want to see that you actually finished your degree program at a qualifying school. This typically means your college or university needs to be accredited and eligible for federal financial aid programs. You can verify this through the Title IV-accredited school database. Most lenders will ask for a copy of your diploma or official transcripts as proof.

Citizenship status matters too. You’ll generally need to be a U.S. citizen or permanent resident to qualify for most refinancing programs. This is pretty standard across the lending industry.

Your payment history speaks volumes about your financial responsibility. Lenders love seeing a track record of on-time payments on your existing student loans. Even if you’ve had a few bumps in the road, a recent history of consistent payments can work in your favor. After all, payment history is the biggest factor in determining your credit score.

Finally, there’s usually a minimum loan amount requirement. Most lenders won’t bother with very small loans because the paperwork and processing costs aren’t worth it for them. These minimums typically start around $5,000 to $10,000, though it varies by lender.

The beauty of these additional requirements is that they give you multiple ways to strengthen your application. Even if your credit score isn’t perfect, showing strong performance in these other areas can tip the scales in your favor.

What to Do If You Don’t Meet the Refinancing Requirements

Finding out you don’t quite meet the minimum credit score to refinance student loans or other requirements can feel disappointing. But here’s the thing – this isn’t a permanent “no.” It’s more like a “not quite yet,” and that’s actually good news because it means you have clear steps to take.

Think of it as getting feedback on a paper before the final draft. You know exactly what needs improvement, and once you make those changes, you’ll be in a much stronger position to qualify for better rates and terms.

The beauty of credit scores and financial profiles is that they’re not set in stone. With some focused effort and the right strategies, you can significantly improve your chances of qualifying for refinancing – often in just a few months.

Actionable Steps to Improve Your Credit Score

Your credit score is like a garden – with consistent care and attention, it will grow. The good news is that some changes can start showing results relatively quickly, while others build lasting strength over time.

Paying your bills on time is absolutely the most important thing you can do. Your payment history makes up about 35% of your credit score, so this single habit has enormous impact. Set up automatic payments or phone reminders – whatever works for your lifestyle. Even one missed payment can ding your score, but consistent on-time payments will steadily build it up.

Reducing your credit card balances is the second most powerful move. Your credit utilization ratio – how much of your available credit you’re using – accounts for about 30% of your score. If you’re carrying balances close to your credit limits, paying them down can boost your score surprisingly fast. Aim to keep your utilization below 30%, but if you can get it under 10%, even better.

Disputing errors on your credit report might seem tedious, but it’s worth the effort. Studies show that a significant percentage of credit reports contain mistakes. Check your reports from all three bureaus (you can get them free at annualcreditreport.com) and dispute anything that looks wrong. Sometimes fixing an error can give your score a nice bump almost immediately.

Becoming an authorized user on someone else’s account can be a smart strategy if you have a family member or trusted friend with excellent credit. Their good payment history can help boost your score, but make sure they’re financially responsible – you’ll be affected by their payment habits too.

Avoiding new debt while you’re working on improvement is crucial. Each new credit application creates a small temporary dip in your score, and taking on more debt can hurt your utilization ratio. Stay focused on paying down what you have rather than adding to it.

Building credit takes time, but many people see meaningful improvements within 3-6 months of consistent good habits.

Using a Co-signer to Qualify for Refinancing

If your credit score isn’t quite where it needs to be, a co-signer can be your ticket to qualifying for refinancing right now. A co-signer is someone – often a parent, spouse, or other trusted adult – who agrees to be equally responsible for your loan. Their strong credit history and stable income essentially strengthen your application.

How a co-signer helps is straightforward: lenders look at both of your financial profiles together. If your co-signer has excellent credit and a solid income, it can completely change how lenders view your application. You might qualify for rates that would normally require a much higher credit score.

Co-signer responsibilities are serious, though, and it’s important that both of you understand what you’re signing up for. Your co-signer is legally responsible for the full loan amount. If you miss payments, it affects both of your credit scores. If something happens and you can’t pay, they’re on the hook for the entire balance.

The credit impact affects both parties throughout the life of the loan. On-time payments help both credit scores, but late or missed payments hurt both of you. This shared responsibility means clear communication about the loan status is essential.

Here’s where it gets even better: co-signer release options are available with many lenders. This feature allows you to remove your co-signer from the loan after you’ve proven yourself as a reliable borrower. Typically, you’ll need to make 12-36 consecutive on-time payments and meet certain credit and income requirements.

This release option makes co-signing much more appealing for potential co-signers because they know there’s a clear path to get out of the responsibility once you’ve demonstrated you can handle the loan on your own. Always look for lenders that offer this feature – it’s a win-win for everyone involved.

Key Considerations Before You Apply

Before we click that “apply” button, let’s take a deep breath and look at the full picture. Refinancing student loans can be a fantastic financial move, but it’s also one that deserves careful thought. Think of it like choosing a new apartment – we want to make sure we’re not just looking at the shiny new kitchen, but also considering what we might be giving up from our current place.

The Risks of Refinancing Student Loans

Here’s the thing about refinancing federal student loans: once you do it, there’s no going back. When we refinance federal loans with a private lender, we’re essentially trading in our federal loan benefits for potentially lower interest rates. It’s a one-way street that can save us money, but we need to understand what we’re leaving behind.

Federal loans come with some pretty valuable safety nets. Income-driven repayment plans can be a lifesaver when money gets tight – they adjust our payments based on what we actually earn, not just what we owe. If we’re struggling financially, these plans can bring our monthly payments down to as little as $0 in some cases.

Then there’s loan forgiveness. Public Service Loan Forgiveness (PSLF) can wipe out remaining loan balances after 10 years of qualifying payments for those working in government or eligible nonprofits. Other forgiveness programs kick in after 20-25 years on income-driven plans. Once we refinance federal loans, we wave goodbye to all of these programs forever.

Federal deferment and forbearance options are also more generous than what most private lenders offer. Going back to school, facing unemployment, or dealing with economic hardship? Federal loans typically provide more flexible options to pause or reduce payments during tough times.

The key question we need to ask ourselves: Do we need these federal protections? If we’re in a stable career with steady income and aren’t pursuing loan forgiveness, refinancing might make perfect sense. But if there’s any chance we might need that federal safety net, we should think twice before giving it up.

For a complete rundown of what federal programs offer, check out: Learn about student loan programs and protections.

How to Prepare Your Application

Getting our paperwork ready ahead of time makes the whole process so much smoother. Nothing’s more frustrating than getting halfway through an application and realizing we need to hunt down a document that’s buried somewhere in our files.

Lenders want to verify three main things about us: who we are, how much we earn, and what loans we’re looking to refinance. Having everything organized shows we’re serious about this decision and helps speed up the approval process.

For identity verification, we’ll need a government-issued ID like our driver’s license or passport. Pretty straightforward stuff.

Income documentation is where things get a bit more involved. Recent pay stubs from the last month or two show our current earnings, while tax returns (usually the past two years) give lenders a broader picture of our financial situation. If we’re self-employed, we might need additional financial records to prove our income stability.

Our current loan statements are crucial because they show exactly what we’re refinancing – the balances, interest rates, and who’s currently servicing our loans. Having these ready saves time and ensures accuracy in our application.

Many lenders also want proof of graduation, typically a diploma copy or official transcripts. This confirms we completed our education at an eligible institution, which is often a requirement for refinancing.

The more organized we are upfront, the faster we can move through the application process. For a detailed walkthrough of what to expect at each step, we’ve put together a comprehensive guide: How to Refinance Student Loans Step-by-Step.

Even if we don’t meet the minimum credit score to refinance student loans right now, getting these documents together helps us understand exactly where we stand financially. Sometimes seeing everything laid out clearly gives us the motivation we need to improve our credit score or explore other options like adding a co-signer.

Frequently Asked Questions About the Minimum Credit Score to Refinance Student Loans

We get it – figuring out the minimum credit score to refinance student loans can feel like solving a puzzle with missing pieces. You’re not alone in having questions, and we’re here to clear up the confusion with straight answers to the questions we hear most often.

What is the absolute minimum credit score to refinance student loans?

Here’s where things get interesting – there isn’t really one magic number that applies everywhere. While 670 is the sweet spot that most lenders prefer, the actual minimum can vary quite a bit depending on who you’re working with.

Some lenders will consider borrowers with scores in the low-to-mid 600s, and a few might even work with scores in the higher end of the fair range (around 620-650). But here’s the catch: having a lower score doesn’t automatically disqualify you, but it does mean lenders will look extra closely at everything else.

They’re hunting for what we call “compensating factors” – things that make you less risky despite the lower score. Maybe you have a really high income compared to your debt, or your debt-to-income ratio is impressively low. Sometimes, having a co-signer with excellent credit can be the golden ticket that opens doors.

The bottom line? A score below 670 makes the path trickier, but it’s not necessarily a dead end. You’ll just need to shop around more and potentially accept higher rates or stricter terms.

Does checking my eligibility for student loan refinancing hurt my credit score?

This worry keeps a lot of people from even exploring their options, but we have great news for you! Simply checking your eligibility typically won’t hurt your credit score at all.

Most lenders use what’s called a “soft credit check” when you’re just browsing and getting prequalified. Think of it like window shopping – you can look around, compare rates, and get estimated offers without leaving any footprints on your credit report. This means you can safely check with multiple lenders to find your best deal.

The story changes only when you decide to formally apply with a specific lender. That’s when they’ll do a “hard credit check,” which can cause a small, temporary dip in your score – usually just a few points. But don’t let this scare you off! This tiny dip is completely normal when applying for any type of credit, and your score typically bounces back quickly with good payment habits.

The potential savings from securing a lower interest rate almost always outweigh this minor, short-term impact on your credit.

Can I refinance only some of my student loans?

Absolutely, and this flexibility is actually one of the smartest features of refinancing! You have complete control over which loans you include, allowing you to create a strategy that perfectly fits your situation.

This selective approach opens up some really clever possibilities. You might choose to target only your highest-interest loans while leaving the lower-rate ones alone – this maximizes your savings without unnecessarily complicating loans that are already working in your favor.

Or maybe you want to keep your federal loans untouched because you’re working toward Public Service Loan Forgiveness or rely on income-driven repayment plans. In that case, you could refinance just your private loans to get better rates while preserving those valuable federal protections.

Some borrowers use selective refinancing to simplify their payment schedule by combining just a few loans into one new payment, making their monthly finances less complicated without touching every single loan they have.

This flexibility means you’re never locked into an all-or-nothing decision. You can be strategic and make refinancing work exactly how you need it to.

Conclusion: Your Path to a Better Student Loan

We’ve covered a lot of ground together, and if you’re feeling a bit overwhelmed, that’s completely normal! Understanding the minimum credit score to refinance student loans is just one piece of the puzzle, but it’s an important one that can open up significant savings.

Here’s what we know: while that magic number of 670 gives you the best shot at approval and great rates, it’s not the end of the world if you’re not there yet. We’ve seen how borrowers with fair credit can still find options, especially when they bring a co-signer to the table or have other strong financial factors working in their favor.

Your credit score is important, but it’s not the whole story. Lenders want to see that complete picture – your debt-to-income ratio, your steady income, your history of making payments on time. These all matter just as much as those three digits.

If you’re not quite ready to apply today, that’s perfectly fine. We’ve given you a roadmap for improving your credit score and strengthening your overall financial profile. Small steps like paying bills on time and reducing credit card balances can make a big difference over time.

But here’s the thing we really want you to remember: refinancing isn’t right for everyone. If you have federal loans and you’re counting on income-driven repayment plans or loan forgiveness programs, think carefully before making the switch. Once you refinance federal loans into private ones, there’s no going back to those federal protections.

At Stayplain Locaseo, we’re not just here to give you information and send you on your way. We genuinely care about helping you make the smartest decisions for your unique situation. Student loans don’t have to control your life forever. With the right strategy and support, you can take charge of your debt and work toward the financial freedom you deserve.

Ready to explore your options? Check your credit score, gather those documents we talked about, and start comparing what’s out there. And remember, we’re here to help every step of the way.

Take the next step on your journey: Explore all our Student Loan Refinancing resources and find how much you could save.