Why Understanding Refinancing Risks Could Save Your Financial Future

When you refinance student loans and lose forgiveness, you permanently give up federal benefits that could save you thousands. This irreversible trade-off affects millions of borrowers who may not realize what they’re sacrificing for a potentially lower interest rate.

Need a refresher on the basics before we dive in? Check out our quick guides on student loan forgiveness explained and the student loan refinancing calculator.

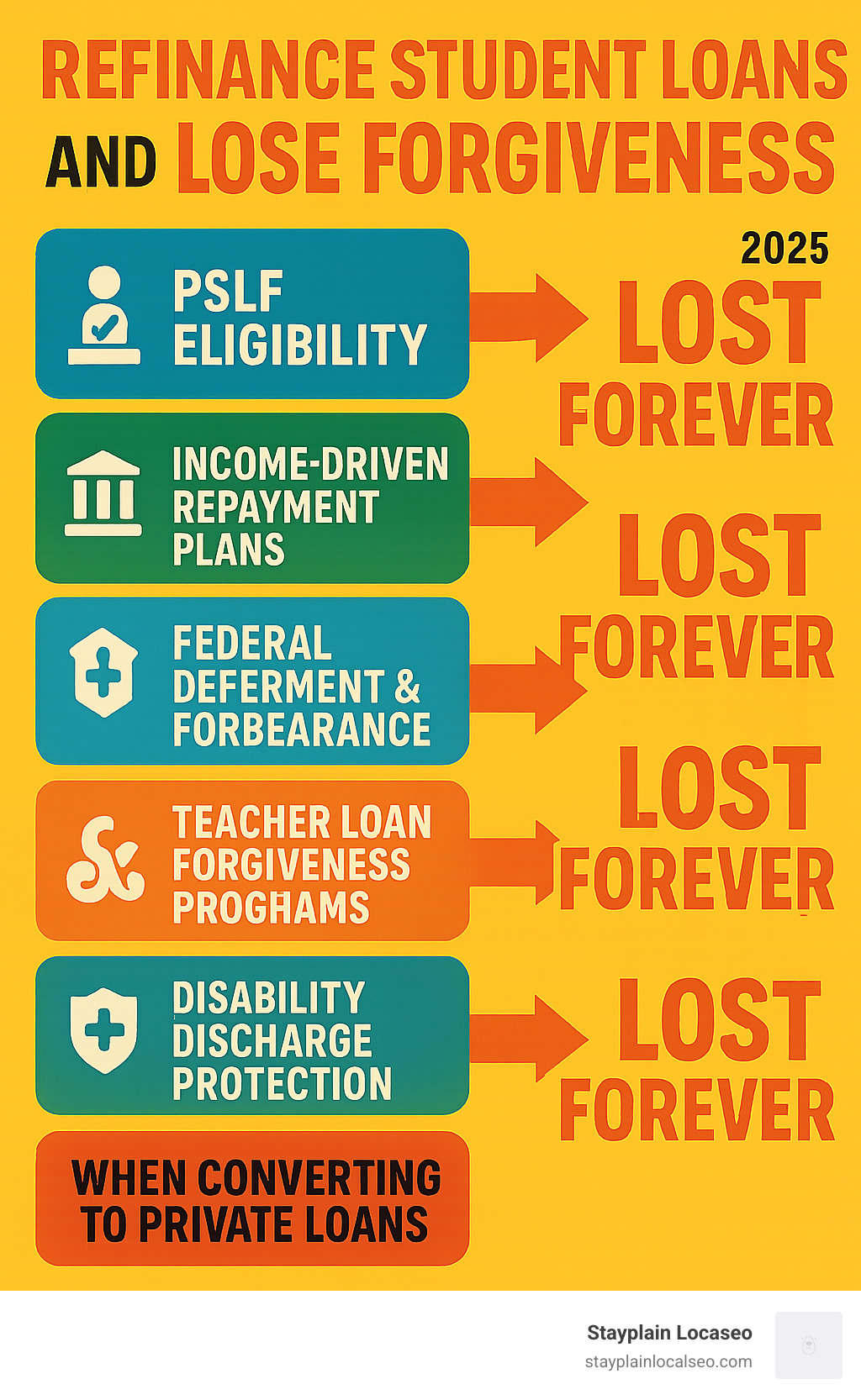

Quick Answer: What You Lose When You Refinance Federal Student Loans

- Public Service Loan Forgiveness (PSLF) – Potentially hundreds of thousands in forgiveness

- Income-Driven Repayment Plans – Payments as low as $0 based on income

- Federal Deferment & Forbearance – Payment pauses during hardship

- Teacher Loan Forgiveness – Up to $17,500 for qualifying educators

- Total Disability Discharge – Complete loan forgiveness for permanent disability

- Federal Safety Nets – Unemployment protection and flexible options

The allure of refinancing is clear: private lenders promise lower interest rates. But here’s the catch: refinancing federal loans converts them into private loans forever.

As Betsy Mayotte, president of The Institute of Student Loan Advisors, warns, she has seen borrowers miss out on over $400,000 in forgiveness after refinancing based on bad advice.

Under the Biden administration, nearly 4.6 million people have had almost $160 billion in federal education loans cleared. If you refinance, you disqualify yourself from current and future federal forgiveness programs.

The decision to refinance isn’t just about today’s interest rate—it’s about your financial future. Federal loans offer protections that private lenders cannot match, and once you give them up, there’s no going back.

For those struggling with student loan debt management, understanding these risks is crucial. You might also explore alternative repayment strategies before making this permanent decision. If you need extra inspiration for improving your finances, see the popular 7-Second Tesla Ritual or our community-favorite WealthGenix method.

Simple guide to refinance student loans and lose forgiveness terms:

- how to refinance student loans step by step

- minimum credit score to refinance student loans

- refinance student loans no degree

- Bonus side-hustle idea: earn extra cash with Live Chat Jobs while you research your options!

The Irreversible Trade-Off: What You Permanently Lose When Refinancing Federal Loans

Refinancing federal loans is a one-way street. When you refinance student loans and lose forgiveness, you permanently convert them into private loans. This decision cannot be reversed.

Federal student loans are more than just debt; they include a toolkit of borrower rights and safety nets that private lenders don’t offer. When you refinance, you’re trading this comprehensive toolkit for a potentially lower interest rate, but you lose the security that comes with it.

Forfeiting Access to Federal Forgiveness Programs

The biggest risk is losing access to forgiveness. Borrowers just months away from having their loans wiped out have lost everything by refinancing.

- Public Service Loan Forgiveness (PSLF): This is the most significant program. If you work for a qualifying non-profit or government organization, your entire remaining balance could be forgiven after 120 payments (10 years). Potential savings can exceed $400,000.

- Teacher Loan Forgiveness: Offers up to $17,500 in forgiveness for educators who teach for five consecutive years in low-income schools.

- Income-Driven Repayment (IDR) Forgiveness: After 20-25 years of payments on an IDR plan, any remaining balance is forgiven, providing a guaranteed end date for your debt.

- Total and Permanent Disability Discharge: Provides complete loan forgiveness if you become permanently disabled, offering critical peace of mind.

The federal government also offers discharge for school closures or fraud—protections unavailable with private loans. You can explore these options at the official Student Loan Forgiveness Programs page.

Losing Flexible Repayment and Protection Plans

Federal loans offer a financial safety net that adapts to your life. Private loans are rigid contracts that are less forgiving of job loss or medical emergencies.

- Income-Driven Repayment (IDR) Plans: These are game-changers. The new SAVE plan can lower payments to 5% of your discretionary income, sometimes even $0 per month.

- Deferment: Lets you pause payments during unemployment, economic hardship, or military service. Interest doesn’t accrue on subsidized loans during deferment.

- Forbearance: Offers another layer of protection if you don’t qualify for deferment but still need a temporary pause in payments.

Private lenders may offer hardship options, but they aren’t required to, and their policies can change. For details on federal options, see the government’s page on income-driven repayment plans.

The Critical Difference: Federal Consolidation vs. Private Refinancing

Many borrowers confuse these terms, but they are fundamentally different.

- Federal Direct Consolidation: This combines multiple federal loans into one new federal loan. Your interest rate becomes a weighted average of the original rates. Crucially, your loan remains federal, and you keep all your benefits.

- Private Refinancing: A private company pays off your federal loans and issues you a new private loan. Your federal loans are gone forever, along with all their protections.

For example, older FFEL loans that aren’t eligible for PSLF can become eligible if you consolidate them into a Direct Consolidation Loan. If you refinance them privately, you lose that opportunity forever. Once you sign the private refinancing paperwork, there is no going back.

If you’re considering either option, our guide on how to refinance student loans step-by-step can clarify the process.

The Financial Risks When You Refinance Student Loans and Lose Forgiveness

The promise of a lower interest rate is tempting, but it can be a financial trap. When you refinance student loans and lose forgiveness, you might end up paying more in the long run, even with a lower rate.

The Variable Rate Trap vs. Fixed Federal Rates

Private lenders often advertise low variable interest rates. While appealing compared to a 6% federal rate, these rates are tied to market conditions and can rise significantly over time. A sudden increase could strain your budget unexpectedly.

In contrast, federal student loans have fixed interest rates that never change. This predictability is a valuable tool for long-term financial planning. While private lenders offer fixed rates, they are typically higher than their advertised variable rates. Understanding these risks is key, much like how some use breakthrough manifestation techniques to gain financial clarity.

Calculating the Total Cost: When a Lower Rate Isn’t a Better Deal

A common refinancing mistake is overlooking the total cost. A lower monthly payment often comes with a longer repayment term, such as 15, 20, or 25 years instead of the standard 10.

Here’s a quick example: Refinancing a $50,000 loan from 6.5% over 10 years to 5% over 20 years might lower your monthly payment from $567 to $330. However, your total interest paid would jump from roughly $18,000 to $29,000. That “better” rate could cost you an extra $11,000.

This is why analyzing short-term savings versus long-term cost is essential. A lower monthly payment might improve cash flow now but could hinder long-term goals like homeownership or retirement. If you’re considering refinancing, check the minimum credit score requirements first, as this impacts the rates you’re offered.

Understanding the Tax Implications of Refinancing

Tax implications are another important factor. The student loan interest deduction of up to $2,500 per year typically applies to both federal and refinanced private loans.

However, the tax treatment of forgiveness is a major difference. Federal loan forgiveness under programs like PSLF is generally not considered taxable income at the federal level. If you have $50,000 forgiven, you likely won’t owe federal taxes on it.

If a private lender ever forgives a portion of your debt, that forgiven amount might be considered taxable income. This could result in a surprise tax bill for thousands of dollars. We always recommend consulting a qualified tax advisor before making a final decision to understand the potential tax impact on your specific situation. Building a comprehensive financial strategy, sometimes aided by concepts like those in WealthGenix, requires considering all these interconnected factors.

Is It Ever a Good Idea to Refinance and Lose Forgiveness?

After learning about the risks, you might wonder if it’s ever a good idea to refinance student loans and lose forgiveness. The answer is yes, but only for a very small number of borrowers in specific circumstances.

Think of federal protections as financial insurance. Most people shouldn’t give them up, but for a select few, the trade-off might be calculated.

The Ideal Borrower Profile for Refinancing Federal Loans

A borrower who might consider refinancing federal loans typically has:

- A high, stable income that makes income-driven repayment plans unnecessary.

- An excellent credit score (usually 750+) to qualify for the lowest private rates.

- No eligibility for any federal forgiveness programs (e.g., they don’t work in public service).

- A large emergency fund and confidence they won’t need federal safety nets like deferment or forbearance.

Even if you fit this profile, proceed with extreme caution. Life is unpredictable, and federal protections are valuable. Before proceeding, understand the minimum credit score to refinance student loans.

A Safer Bet: Refinancing Existing Private Student Loans

Here’s where refinancing is often a great move: if you already have private student loans. Since private loans lack federal benefits, you’re not giving anything up by refinancing them.

If your credit has improved since you took out the original loans, you could secure a lower interest rate, potentially saving thousands. Refinancing can also simplify your finances by combining multiple private loans into a single monthly payment. This is a pure optimization strategy, improving your loan terms without sacrificing any benefits.

What Consumer Advocates and Financial Experts Advise

The expert consensus on refinancing federal loans is clear: proceed with extreme caution, if at all.

Betsy Mayotte of The Institute of Student Loan Advisors simply says, “DON’T!” She has seen too many borrowers lose out on significant forgiveness based on incomplete advice. Experts warn that private lenders aggressively market lower payments while downplaying the permanent loss of federal protections.

The universal recommendation is to exhaust all federal options first. Explore IDR plans, check your forgiveness eligibility, and understand federal consolidation. Only after confirming that no federal program can help you should you even consider private refinancing. If you do, perform extensive due diligence and be certain you understand what you’re sacrificing. Even if you don’t have a degree, the same caution applies.

Frequently Asked Questions about Refinancing and Forgiveness

We know this topic is complex. Here are clear, honest answers to the most common questions we hear from borrowers.

Can I reverse the process if I refinance student loans and lose forgiveness?

No, the process is permanent and irreversible. Once a private lender pays off your federal loans, they become private debt forever. There is no government program or process to convert them back to federal loans.

This is a critical point to understand. We’ve seen borrowers who refinanced just before major federal relief programs were announced, and their regret was significant. This decision impacts your entire repayment journey, so be certain. Making informed choices is key, a principle some apply to their broader financial life through powerful manifestation techniques.

What’s the difference between refinancing and consolidating my federal loans?

This is a common point of confusion. Though the terms sound similar, the outcomes are completely different.

- Federal Consolidation: You combine multiple federal loans into a new federal loan. You keep all your federal benefits and forgiveness eligibility.

- Private Refinancing: A private lender pays off your federal loans and gives you a new private loan. You lose all federal benefits and forgiveness eligibility.

Remember: consolidation keeps you in the federal system; refinancing moves you out of it permanently. Our guide on how to refinance student loans step-by-step explains the process in more detail.

Can I refinance only some of my federal loans?

Yes, this strategy is called partial refinancing. You can choose to refinance only some of your federal loans—perhaps those with the highest interest rates—while keeping others federal to retain their benefits.

For example, you might refinance high-rate undergraduate loans while keeping your graduate loans federal to pursue Public Service Loan Forgiveness. However, this approach still carries risks. The refinanced loans permanently lose their federal protections, and you’ll have to manage payments to both federal and private servicers.

Before attempting this, ensure you meet the minimum credit score to refinance student loans to get a rate that makes the trade-off worthwhile. A holistic approach to your finances, including exploring wealth-building opportunities, can help you make a more confident decision.

Conclusion: Making the Right Choice for Your Financial Future

Navigating your student loan options can be empowering. By now, you should have a clear understanding of what it means when you refinance student loans and lose forgiveness.

The reality is that federal loans come with a safety net that private lenders cannot replicate. When you refinance, you trade away income-driven repayment, forgiveness programs like PSLF, and critical hardship protections. This is a permanent decision.

For most borrowers, keeping federal loans federal is the wisest choice. The peace of mind that comes with having options during tough times is often more valuable than a slightly lower interest rate.

Of course, every situation is unique. If you are a high earner with excellent credit and no eligibility for federal benefits, refinancing might be a consideration. Even then, we urge you to think carefully before permanently giving up those safety nets.

Our Recommendation: Always explore your federal options first. Investigate income-driven repayment plans and check your eligibility for forgiveness. If you have existing private loans, they are excellent candidates for refinancing, as you lose no federal benefits.

Making smart financial decisions sometimes requires a shift in mindset. Just as some find success through rituals that focus on attracting wealth, approaching your loans with a clear, long-term strategy can transform your financial future.

This isn’t just about numbers; it’s about building a secure financial foundation. Don’t rush into a decision based on a marketing offer. Take your time, run the numbers, and honestly assess your future needs.

At Stayplain Localseo, we are committed to helping you make these important financial decisions with confidence. We want to help you pay off your loans smarter and faster.

Explore our Student Loan Refinancing guides for more help and find the resources you need to succeed.