Why You Can Still Refinounce Student Loans Without a Degree

It’s possible to refinance student loans no degree, even though many lenders prefer graduates. With around 40% of college students not earning a degree, you’re not alone, and you’re not stuck with high-interest loans.

Here’s what you need to know about refinancing without a degree:

- Yes, you can refinance – Several lenders offer this option to non-graduates.

- Requirements are stricter – You’ll need good credit (typically 650+) and stable income.

- Fewer options available – Not all lenders accept borrowers without degrees.

- Credit matters more – Your financial profile is the primary qualification factor.

- Federal benefits are lost – Refinancing federal loans means losing access to forgiveness and income-driven repayment plans.

Lenders may view non-graduates as higher risk due to lower median earnings ($1,057 weekly vs. $1,541 for bachelor’s degree holders), making the process more challenging. However, lenders like Citizens Bank, MEFA, and PNC prioritize your current financial health—credit score, income, and payment history—over your educational background.

Specific criteria may include a minimum income of $24,000, a history of on-time payments, or having left school several years ago. The key is finding lenders who work with non-graduates and meeting their requirements to lower your interest rate, reduce payments, or simplify your loans.

Refinance student loans no degree terms at a glance:

The Pros and Cons of Refinancing Student Loans Without a Degree

Deciding to refinance student loans no degree in hand requires weighing the pros and cons for your specific situation.

Key Benefits of Refinancing

The main advantages of refinancing are saving money and simplifying your finances.

Lower monthly payments are a primary benefit. By securing a lower interest rate or extending your repayment term, your monthly obligation can drop. For example, refinancing a $30,000 loan from 8% to 5% could lower your payment from $364 to $318, saving you nearly $50 monthly and about $3,500 in total interest.

A lower interest rate is the core of refinancing. A lower rate means more of your payment goes toward your principal balance, reducing the total cost of the loan.

Simplified payments offer significant relief if you’re juggling multiple loans. Refinancing combines them into a single loan with one payment, one due date, and one servicer.

Refinancing can also provide cosigner release. After a set number of on-time payments (often 24-48), many lenders will release your cosigner from their financial obligation.

Finally, fixed-rate security offers predictable payments. If you have variable-rate loans, refinancing to a fixed rate protects you from market fluctuations and potential payment increases.

Potential Drawbacks and Risks

Refinancing isn’t always the right move, especially if you have federal loans.

The most significant risk is the loss of federal protections. When you refinance federal loans with a private lender, you permanently give up access to federal benefits.

This includes forfeiting loan forgiveness programs like Public Service Loan Forgiveness (PSLF), which can forgive the remaining balance for those in public service careers after 10 years of payments.

You also forfeit income-driven repayment plans, which base your monthly payment on your income and can be as low as $0. Private lenders rarely offer this level of flexibility.

Applying for refinancing results in a hard credit inquiry, which can temporarily lower your credit score by a few points.

You will likely find fewer lender options as a non-graduate, so you’ll need to research which lenders work with your profile.

You may also face potentially higher rates than graduates with similar financial profiles, as some lenders view non-graduates as a higher risk. Weigh these pros and cons carefully. If you have private loans or a stable income, the savings could be substantial. But if you rely on federal protections, refinancing might not be the best choice.

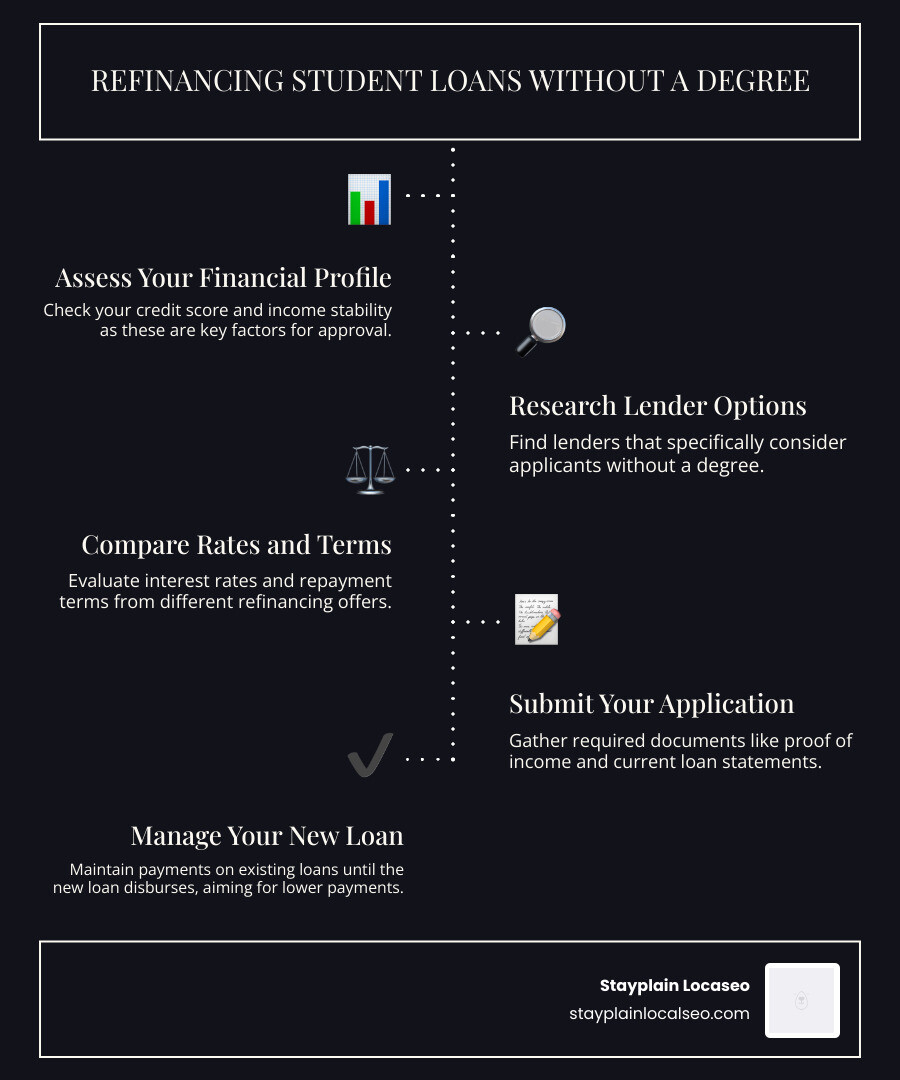

How to Qualify and Apply to Refinance Student Loans No Degree

To refinance student loans no degree, lenders will scrutinize your financial profile. Here’s what you need to qualify and apply.

Core Eligibility Requirements Beyond a Diploma

Without a degree, lenders focus heavily on your financial health.

Your credit score is crucial. Most lenders require a score of 650 or higher, with the best rates reserved for scores in the 700s. A strong score demonstrates responsible financial behavior.

Stable income is essential. Lenders need proof you can make payments, typically requiring a minimum annual income between $24,000 and $36,000 and consistent earnings.

A solid employment history of at least one to two years shows stability.

A low debt-to-income (DTI) ratio is key. Lenders prefer a DTI under 50%, which is the percentage of your gross monthly income that goes toward debt payments.

A positive payment history on existing loans is vital. Lenders may require 12 to 24 consecutive on-time payments as proof of reliability.

Most lenders also have minimum loan amounts of $5,000 to $10,000. Some may also require that you last attended school at least six years ago.

How a Cosigner Can Strengthen Your Application

If your financial profile is weak, a cosigner with excellent credit and stable income can help. A cosigner is equally responsible for the loan.

A cosigner can help you meet income and credit score requirements. Their financial strength is combined with yours on the application, making approval more likely.

You may also qualify for lower rates with a strong cosigner, saving you money over the loan’s term.

Before applying, discuss cosigner responsibilities. They are legally obligated to pay if you cannot, and missed payments will damage their credit.

Many lenders offer cosigner release after a certain number of on-time payments (typically 24-48), which removes their obligation from the loan.

Gathering Your Documents: A Checklist

Organize your documents beforehand for a smoother application process.

- Proof of income: Recent pay stubs or 1-2 years of tax returns if self-employed.

- Government-issued ID: Driver’s license or passport.

- Social Security number: Required for credit checks.

- Loan statements from current servicers: For every loan you want to refinance, including lender name, balance, interest rate, and account number.

- Proof of address: A recent utility bill or lease agreement.

- Bank account information: For setting up automatic payments, which may offer an interest rate discount.

Finding and Comparing Your Refinancing Options

With your finances and documents in order, it’s time to find the right lender. Comparing your options is key to getting the best deal.

What to Look for in a Lender

When you want to refinance student loans no degree, compare lenders on these key factors:

Interest rates are the most important factor for saving money. Choose between fixed APRs, which remain the same, and variable APRs, which can change with the market. Fixed rates offer stability, while variable rates may start lower but carry more risk.

Repayment terms usually range from 5 to 20 years. Shorter terms have higher monthly payments but lower total interest costs. Longer terms offer lower monthly payments but cost more in interest over time.

Look for no-fee lenders. The best lenders don’t charge application fees, origination fees, or prepayment penalties.

Borrower protections are valuable. While private lenders offer fewer protections than the federal government, some provide forbearance or deferment options for financial hardship.

Read customer reviews to learn about real borrower experiences with a lender’s customer service and application process.

A transparent application process is a good sign. Many lenders let you check your potential rate with a soft credit pull, which doesn’t affect your credit score and allows you to shop around.

Lenders that work with non-graduates have different criteria. For example, some require 12-24 months of on-time payments, while others have minimum income thresholds from $24,000 to $36,000.

Understanding the Impact of Refinancing Federal Loans

Refinancing federal loans is a permanent decision. You trade the versatility of federal benefits for a potentially better rate from a private lender.

When you refinance federal loans, the federal benefits disappear forever. This includes income-driven repayment plans, generous forbearance options, and loan forgiveness programs.

Your loan becomes a private loan, subject to the new lender’s terms, interest rate, and hardship programs.

However, the trade-off can be worthwhile if you have high-interest federal loans and a stable financial situation. The savings from a lower rate could be substantial, and the simplicity of a single payment can be a major benefit.

Assess your financial stability honestly. Federal loans offer a safety net, while private loans may offer better terms but expect you to be self-sufficient. This decision is highly personal and depends on your career stability and financial outlook, especially since median earnings vary by education level.

Alternatives When Refinancing Isn’t an Option

If you can’t refinance student loans no degree right now due to your credit or income, you still have other options to manage your debt.

The financial challenges for non-graduates are real. The median weekly earnings for someone with some college but no degree is $1,057, compared to $1,541 for bachelor’s degree holders. Despite this gap, you can still manage your student debt effectively.

Let’s explore the alternatives that can help you get back on track.

Federal Loan Repayment and Forgiveness Programs

If you have federal student loans, the government offers powerful programs to help, regardless of your degree status.

Income-Driven Repayment (IDR) plans calculate your monthly payment based on your income and family size. This can significantly lower your payment, sometimes to $0.

The SAVE Plan, the newest IDR option, caps payments as a percentage of your discretionary income and prevents unpaid interest from growing your balance. Any remaining balance is forgiven after 20-25 years of payments.

Deferment and forbearance allow you to temporarily pause payments during periods of unemployment or economic hardship, helping you avoid default.

Public Service Loan Forgiveness (PSLF) can forgive your remaining federal loan balance after 120 qualifying payments while working full-time for a government or non-profit organization. A degree is not required to be eligible.

These federal protections are valuable and are lost permanently if you refinance federal loans into a private loan.

Strategies for Managing Private Student Loans

If you have private loans, your options are different but still exist.

Contact your lender directly. Many offer hardship programs that can temporarily reduce or pause your payments. They want to help you avoid default.

Try negotiating your current terms. If your financial situation has improved, your lender might lower your interest rate without a full refinance.

Research your lender’s hardship programs. While not as comprehensive as federal options, they can provide meaningful relief.

Consider non-profit credit counseling. An agency can help you create a budget and develop a debt management strategy. They may also help you consolidate other unsecured debts, freeing up cash for your student loan payments.

Frequently Asked Questions about Refinancing Without a Degree

Here are answers to common questions about how to refinance student loans no degree.

How much does my credit score matter if I don’t have a degree?

Your credit score is extremely important. Without a degree to signal earning potential, lenders rely heavily on your credit history to assess your financial reliability. A strong score (typically 650+, with 700s being ideal) shows you manage debt responsibly.

Your financial profile, especially your credit history, becomes the key to qualifying for low rates and overcoming the no-degree barrier. A non-graduate with a high credit score and stable income can often secure better rates than a graduate with a lower score and less stable employment.

Can I still get loan forgiveness if I refinance?

No. If you refinance federal loans into a private loan, you permanently lose eligibility for federal loan forgiveness programs.

When you refinance, your loans are no longer federal. This means forfeiting federal benefits like Public Service Loan Forgiveness (PSLF) and forgiveness through Income-Driven Repayment plans. The federal vs. private loans distinction is critical; private loans are not eligible for these programs to begin with.

Is it harder to get approved for refinancing without a degree?

Yes, it can be more challenging but is not impossible. Lenders view a degree as an indicator of lower risk and higher earning potential. Without one, their lender risk assessment focuses more on your income and credit.

The importance of credit history is paramount. By proving financial stability through a strong track record of on-time payments and responsible credit use, you can build a compelling case for approval. You may have fewer lender choices, as not all work with non-graduates. However, the ones that do will prioritize your current financial reliability over your educational history. Showcasing consistent employment and a strong credit score can be as persuasive as a diploma.

Conclusion

Managing student loan debt without a degree takes determination, but it’s achievable. You now have the information needed to take control of your financial future.

The bottom line is simple: yes, you absolutely can refinance student loans no degree. It may require more research, but many have done it successfully.

Your financial profile is your key asset. A strong credit score, steady income, and positive payment history demonstrate your reliability to lenders and can open up lower rates and better terms.

But remember – refinancing isn’t always the right answer. For those with federal loans, the safety net of income-driven repayment plans and loan forgiveness programs can be more valuable than a lower interest rate.

Knowledge is crucial. Compare lenders thoroughly, understand the terms, and don’t be afraid to ask questions. Finding a lender that is flexible with non-graduates can significantly improve your outcome.

At Stayplain Localseo, we believe that financial empowerment shouldn’t depend on whether you walked across a graduation stage. Making informed decisions is the key to achieving your goals.

Whether you decide to refinance, explore federal repayment options, or pursue alternative strategies, you’re not stuck with unmanageable debt forever. Your journey to smarter student loan management starts now.