Why Student Loan Eligibility Checkers & Qualification Tools Are Your Financial Game-Changer

A student loan eligibility checker is a free online tool that helps you determine which loans you qualify for and estimate potential loan amounts without affecting your credit score. These tools are essential for smart education financing.

Quick Guide to Student Loan Eligibility Checkers:

- Federal loans: Use the Federal Student Aid Estimator for a fast estimate (5-10 minutes).

- Private loans: Use online comparison tools to check rates from multiple lenders in minutes.

- No credit impact: Pre-qualification tools use soft inquiries that don’t harm your credit score.

- Key benefits: Compare lenders, estimate loan amounts, and avoid application rejections.

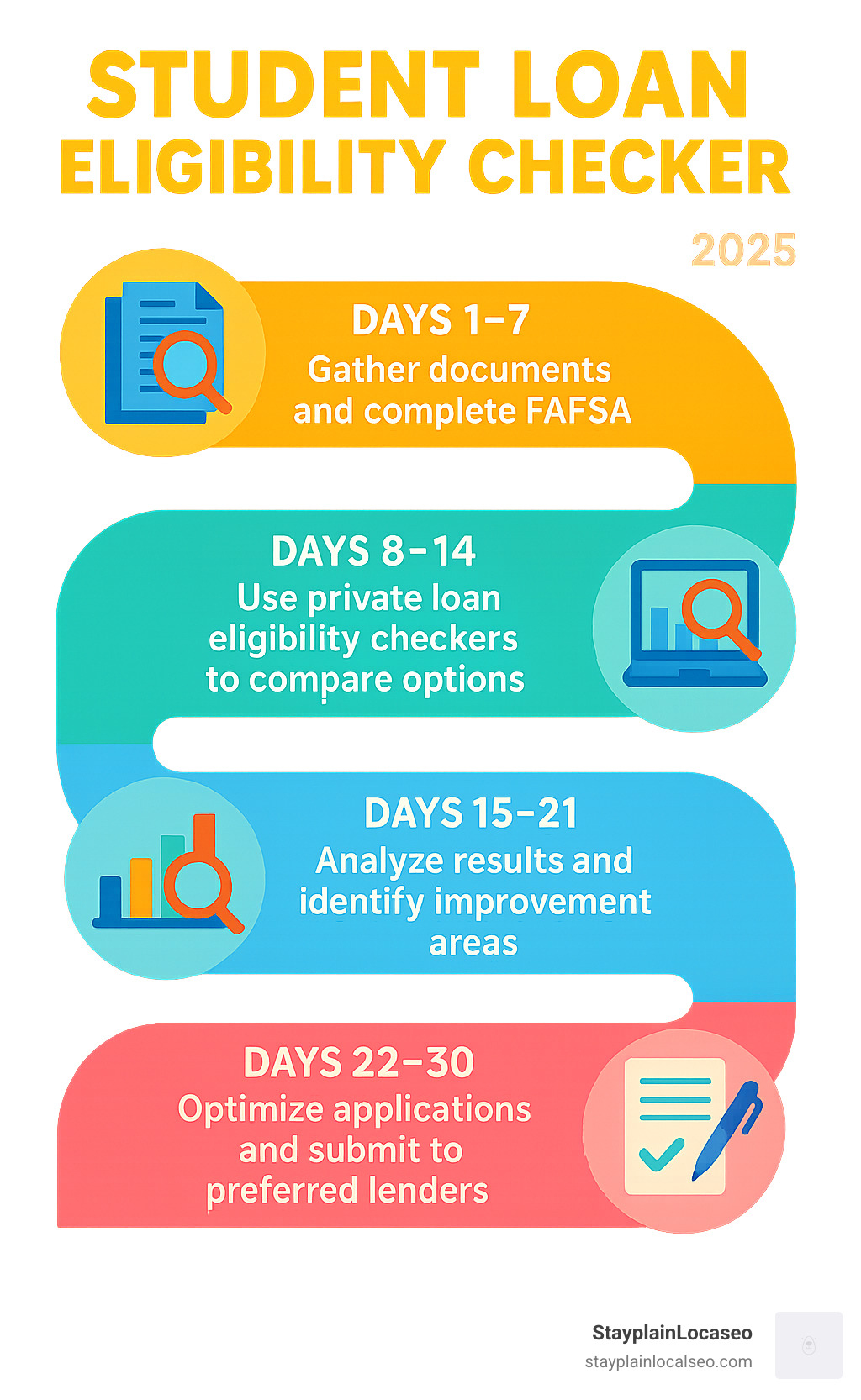

If you’re planning your education financing, you’re not alone. Before you can optimize your loans, you need to understand what you qualify for. The good news is you can master student loan eligibility in just 30 days with the right approach.

Eligibility checkers remove the guesswork from borrowing. Instead of applying blindly and risking rejection (which can hurt your credit score), these tools show you your options upfront. The Federal Student Aid Estimator provides an estimate of how much federal aid you may receive based on your Student Aid Index (SAI).

For private loans, comparison platforms give you an approximation based on your finances, requiring details about your income, obligations, and desired loan term. Whether you’re a high school senior, a current student, or looking to refinance, understanding your eligibility is the first step toward financial freedom.

Related content about Student loan eligibility checker:

What Are Student Loan Eligibility Checkers (Loan Qualification Tools) and Why Use Them?

Think of a student loan eligibility checker as your financial GPS – it shows you where you stand before you start your borrowing journey. These online tools provide a clear picture of which loans you might qualify for and how much you could borrow, all without impacting your credit score.

You’ll answer straightforward questions about your academic status, citizenship, and finances. The checker then estimates your borrowing capacity. Why bother? These tools are game-changers for smart borrowers.

- Financial Planning: Knowing your borrowing limits upfront helps you make informed decisions about college affordability.

- Time-Saving: Instead of filling out multiple lengthy applications, you get a comprehensive overview in minutes. Some platforms let you check rates with over 15 lenders at once.

- Avoiding Rejection: Applying for a loan you don’t qualify for can hurt your credit score. Checkers help you set realistic expectations.

- Comparison Advantage: Many tools show you options from multiple lenders side-by-side, so you can easily spot the best deals.

How an Eligibility Checker Tool Simplifies Your Loan Application

The student loan application process can feel confusing. A student loan eligibility checker turns that confusion into clarity.

Pre-qualification is your secret weapon. When you use private loan eligibility checkers, you get a sneak peek at potential loan amounts and interest rates without a hard credit inquiry, which can temporarily lower your score. With pre-qualification, you can shop for loans without consequences.

The real beauty is in comparing multiple lenders simultaneously. Modern tools eliminate the headache of researching individual lenders by showing you rates and terms from 15+ lenders in one simple process.

Understanding your potential loan amounts and interest rates empowers you to plan ahead. These tools provide detailed estimates of how much you could borrow and what it might cost, giving you a clear picture of future repayment obligations. This foresight is invaluable for making major educational and financial decisions.

For more comprehensive guidance, check out our More info about our Borrower Tools & Expert Tips.

Top Features of the Best Student Loan Eligibility Checker Tools

Exceptional student loan eligibility checkers have features that transform your borrowing experience.

- No Credit Score Impact: Quality checkers use “soft inquiries” that don’t affect your credit score. You can explore dozens of options without worry.

- Lightning-Fast Results: The Federal Student Aid Estimator provides estimates in 5-10 minutes, while some private loan tools show pre-qualified rates in under two minutes.

- Comparison Features: Good checkers show you what you qualify for across multiple lenders. You can compare loan amounts, interest rates, and terms side-by-side to find the best deals.

- Free Access: The most reliable platforms don’t charge fees, ensuring financial planning resources are available to everyone.

- Rock-Solid Security: Reputable checkers use advanced encryption and follow strict privacy policies to keep your data safe. Always use trusted platforms when entering sensitive information.

For those looking to build wealth while managing student loans, consider exploring opportunities like the #1 Stock Investing Club or high-paying Live Chat Jobs you can do from home to grow your financial portfolio.

Decoding Federal vs. Private Student Loan Eligibility

When exploring student loans, you have two main paths: federal and private. Each has its own rules and benefits. Understanding these differences is essential for making smart borrowing decisions that could save you thousands.

Federal student loans are government-backed and come with safety nets like income-driven repayment plans and potential loan forgiveness. Most undergraduate federal loans don’t require a credit check or a cosigner. For loans disbursed between July 1, 2024, and July 1, 2025, fixed interest rates are 6.53% for undergraduates, 8.08% for graduate students, and 9.08% for Direct PLUS loans.

Private student loans come from banks and credit unions. Your credit score, income, and debt-to-income ratio are critical for approval and determining your interest rate. While they can fill funding gaps, they typically offer fewer borrower protections.

The key difference is that federal loans focus on financial need, while private loans focus on creditworthiness.

Key Eligibility Criteria for Federal Student Loans

Federal loans are often your best first option, designed to be accessible to most students.

- FAFSA: The Free Application for Federal Student Aid (FAFSA) is your ticket to federal funding. You must complete it annually.

- Citizenship: You must be a U.S. citizen or an eligible noncitizen (e.g., a lawful permanent resident).

- Financial Need: For Federal Direct Subsidized Loans, you must demonstrate financial need. With these loans, the government pays the interest while you’re in school at least half-time.

- Enrollment: You must be enrolled at least half-time in an eligible program at a participating school and maintain Satisfactory Academic Progress (SAP).

- No Age Limit: There’s no upper age limit for federal student loans.

We recommend you Complete the one official FAFSA® form online as early as possible each year.

Key Eligibility Criteria for Private Student Loans

Private loans are more selective, as they are designed to be profitable for lenders.

- Credit Score: Lenders run a thorough credit check. Most prefer scores in the mid-600s or higher.

- Income: Lenders scrutinize your income and employment history to ensure you can repay the loan.

- Debt-to-Income (DTI) Ratio: A lower DTI, which compares your monthly debt to your gross income, makes you a more attractive borrower.

- Cosigner Option: A cosigner with good credit and stable income can dramatically improve your chances of approval if your own credit or income is insufficient.

- School Certification: Your school must certify your enrollment and loan amount to prevent over-borrowing.

If you’re considering private loans for refinancing, our guide on how to Find the Lowest Student Loan Refinance Rates can help you find the best deals.

[TABLE] Your Quick Guide: Federal vs. Private Loan Eligibility

Here’s a quick reference guide to see the differences side by side:

| Criteria | Federal Student Loans | Private Student Loans |

|---|---|---|

| Application Process | FAFSA® (Free Application for Federal Student Aid) | Lender-specific application |

| Credit Check Required? | No, for most loans (except PLUS Loans) | Yes, for all loans |

| Interest Rates | Fixed rates, typically lower | Fixed or variable rates, often higher |

| Cosigner Needed? | Rarely | Often required for students |

| Forgiveness Options | Many (PSLF, IDR forgiveness, etc.) | Rare to none |

| Repayment Flexibility | High (IDR plans, deferment, forbearance) | Limited |

| Eligibility Based On | Financial need, enrollment, citizenship | Creditworthiness, income, DTI |

| Loan Limits | Set annual and aggregate limits | Varies by lender, up to Cost of Attendance |

This comparison shows why it’s wise to exhaust federal loan options before turning to private lenders.

Your Ultimate Student Loan Eligibility Checker Guide

Ready to take control? Using a student loan eligibility checker effectively is like having a roadmap for your financial future. Let’s walk through the process.

First, gather your documents: Social Security number, tax returns, bank statements, and investment records. Having these ready ensures accurate results from any eligibility tool.

Next, use online tools strategically. Start with the Federal Student Aid Estimator for federal aid. For private loans, use platforms that compare multiple lenders to save time.

Finally, understand your results. An eligibility checker shows what you could borrow, not what you should. Consider your future earning potential and total education costs before making a decision.

Understanding the FAFSA Form & Your Student Aid Index (SAI)

The FAFSA is your key to federal financial aid, including grants, work-study, and loans. This free form helps the government understand your family’s financial situation.

The Student Aid Index (SAI) has replaced the old Expected Family Contribution. It’s an index number (from -1500 to 999999) that colleges use to determine your aid eligibility. A lower SAI indicates higher financial need. The SAI is calculated using a formula that considers your family’s tax information, assets, and household size. A negative SAI signals very high financial need and often qualifies students for maximum aid, like the full Federal Pell Grant.

We recommend using the Federal Student Aid Estimator for an early estimate before completing the full FAFSA to help plan your financing strategy.

Using a Private Student Loan Eligibility Checker for Pre-Qualification

Private loan eligibility checkers focus on your creditworthiness and ability to repay.

Online marketplaces have revolutionized private loan shopping. You can input your information once and receive pre-qualified offers from multiple lenders. You’ll need personal details, income information, desired loan amount, and school details. If using a cosigner, have their information ready too.

Comparing pre-qualified rates is easy when you see offers side-by-side. Look beyond interest rates to consider loan terms, monthly payments, and fees. Some lenders offer benefits like interest rate reductions for autopay.

Getting pre-qualified creates no obligation to borrow. It’s like window shopping for loans, allowing you to explore all your options without commitment.

Building wealth while managing student loans is possible with the right mindset. Consider exploring resources that help you think differently about money, like this 7-second ritual that attracts money to you or joining the #1 Stock Investing Club to build your wealth.

For more detailed guidance on optimizing your loans after graduation, check out our guide on how to refinance student loans step-by-step.

Key Factors That Determine Your Loan Approval

Getting approved for a student loan involves more than just filling out a form. Lenders examine your financial profile to determine if you’re a good risk. Understanding what they look for gives you the power to improve your chances.

How Your Credit and Income Affect Loan Eligibility

Your credit score is a crucial factor for private student loans, as it reflects your borrowing habits.

For private loans, your credit score is critical. Most private lenders require a minimum credit score, often in the mid-600s or higher. A better score not only improves your approval odds but also helps you secure lower interest rates, saving you thousands.

Federal loans are different. Most federal student loans don’t require a credit check, which is great news for those with limited or poor credit history. The main exception is the Direct PLUS Loan, which checks for an “adverse credit history.”

Your debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income, is also key. Lenders prefer a low DTI. If yours is high, a cosigner can be a huge help.

A cosigner can transform your loan prospects. Someone with strong credit and stable income can help you get approved and secure better rates. Many private lenders even offer cosigner release after a certain number of on-time payments.

Our comprehensive A guide to Student Loan Debt Management can help you stay on top of your loans once you have them.

Citizenship, Age, and Other Key Eligibility Factors

Your background and life circumstances also play a significant role in loan eligibility.

International students have options. While federal loans are generally for U.S. citizens and eligible noncitizens, international students can access private loans. Some lenders specialize in serving this group, sometimes without requiring a U.S. cosigner.

For federal aid, “eligible noncitizen” status includes lawful permanent residents, refugees, asylees, and others with specific humanitarian statuses.

Age matters for private loans, as you typically must be 18 to enter a loan contract. However, federal loans have no upper age limit.

Academic progress is essential. For both federal and private loans, you must maintain Satisfactory Academic Progress (SAP) at your school, which usually involves a minimum GPA and credit completion rate.

We offer a detailed guide on Learn How to Refinance International Student Loans.

The Overlooked Factor: How Your Financial Mindset Influences Loan Eligibility Success

Most student loan eligibility checker tools won’t tell you this: your relationship with money matters. While credit scores and income are what lenders evaluate, your financial mindset can profoundly impact your long-term success.

Building wealth habits starts now, even while borrowing. It’s about managing debt wisely and creating a foundation for future prosperity. This means developing smart budgeting skills and thinking strategically about your financial future.

Your beliefs about money shape your actions. Students who approach loans with a proactive mindset tend to make better decisions. Instead of viewing loans as a burden, consider them an investment in your future earning potential.

Visualizing a debt-free future is a powerful motivational tool. If you’re looking for practical ways to boost income while studying, explore flexible side gigs like high-paying Live Chat Jobs you can do from home or consider joining the #1 Stock Investing Club to build your wealth.

Getting approved is just the beginning. Real success comes from managing debt wisely and building wealth over time.

Frequently Asked Questions About Student Loan Eligibility Checker Tools

Here are answers to some of the most common questions we receive from students and families.

What disqualifies you from getting a student loan?

Understanding potential roadblocks is key. For private loans, the biggest disqualifier is not meeting credit or income criteria. If you or your cosigner don’t meet the lender’s minimums, your application will likely be denied.

For federal loans, a major obstacle is defaulting on a previous federal loan or owing a refund on a federal grant. You won’t be eligible for more aid until the issue is resolved. The government’s “Fresh Start” program can help borrowers in default regain eligibility.

Other disqualifiers include not maintaining Satisfactory Academic Progress (SAP) at your school and not being enrolled in an eligible program at an accredited school. Certain criminal convictions can also affect eligibility, though rules have become more lenient.

Can I get a student loan if I have no degree or bad credit?

Yes, it’s often possible, depending on the loan type.

Federal loans are your best option if you have no or bad credit. Most federal student loans (Direct Subsidized and Unsubsidized) don’t consider your credit history for approval. They are designed to provide access to education regardless of your credit situation.

For private loans, using a cosigner with good credit can be your ticket to approval. Their strong financial standing mitigates risk for the lender.

You also don’t need a previous degree to get a student loan. Eligibility checkers focus on your current enrollment in a qualified program, not your past educational history.

If you’re exploring refinancing without a degree, check out Explore how to Refinance Student Loans with No Degree.

Are there any unconventional ways to fund my education?

Absolutely! Beyond traditional loans, you can explore innovative ways to fund your education and build long-term wealth.

- Build Wealth: Approach your education as an investment. You can start by joining the #1 Stock Investing Club to build your wealth.

- High-Demand Side Hustles: The digital age offers flexible ways to earn money that fit a student’s schedule, such as high-paying Live Chat Jobs you can do from home.

- Financial Mindset: A proactive and positive approach to money can open unexpected avenues for funding. Simple mindset shifts—like visualizing a debt-free future—can be surprisingly powerful.

By combining smart borrowing with extra income opportunities, you can accelerate your path to a debt-free life.

Take Control of Your Financial Future

You’ve journeyed through the essentials of student loan eligibility. From understanding the power of a student loan eligibility checker to mastering the differences between federal and private loans, you’ve gained knowledge that puts you ahead.

Your 30-day mastery plan is clear: gather documents, use eligibility checkers, analyze your results, and submit optimized applications. But this is about more than just getting a loan—you’re taking control of your financial narrative. Every step you’ve learned puts you in the driver’s seat.

You are no longer making blind financial decisions. You know what lenders look for and how to present yourself as a strong borrower. You’ve even found unconventional approaches to building wealth, whether that’s exploring opportunities like joining the #1 Stock Investing Club to build your wealth or finding how this 7-Second Tesla Ritual attracts money to you.

At Stayplain Localseo, we understand the stress of managing student loans. That’s why we created this platform—to make your journey clearer and more accessible.

You have the tools to succeed. You understand how eligibility checkers work and have learned strategies to improve your approval chances. More importantly, you’ve found that proactive steps today shape your financial reality tomorrow.

This is just the beginning of your financial empowerment. We’re here to support you every step of the way. Ready for the next step? Explore our Student Loan Refinancing guides to get started and continue building the financial future you deserve.